ACEA review 2025: electric trucks show isolated gains, electric buses perform across the board

Over the past year, the European truck market has faced persistent buyer reluctance, as highlighted in the latest commercial vehicle figures published by the European Automobile Manufacturers’ Association (ACEA). In contrast, the bus sector has experienced a recovery in dynamics across all drive types. When focusing on the registration of electric commercial vehicles, it is evident that small nations like Switzerland are making significant progress in adopting battery-electric trucks. Meanwhile, Germany has emerged as a leader in the sharply rising registrations of electric buses.

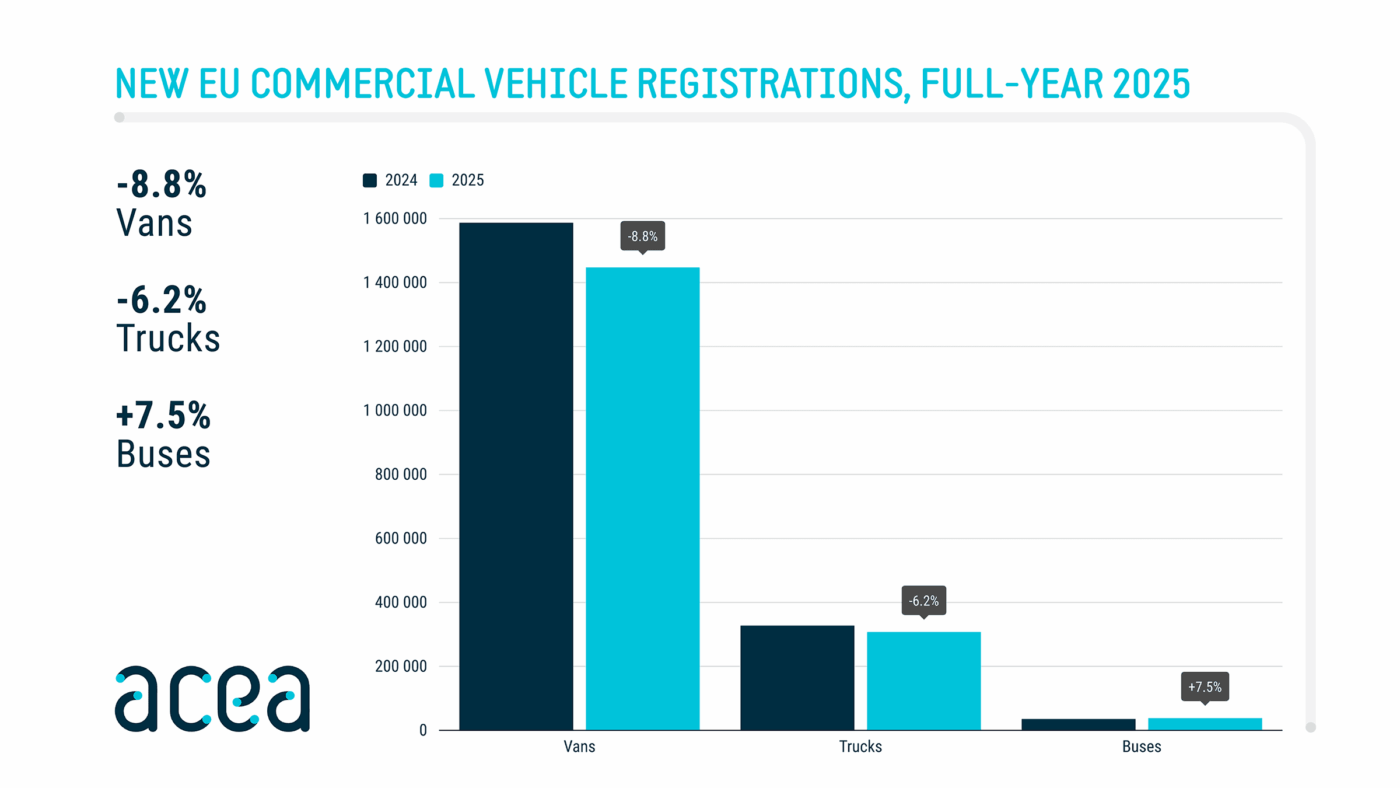

To provide context: ACEA monitors the development of commercial vehicle markets in the EU and across Europe on a quarterly basis. For 2025, the association reports a 6.2% decline in truck registrations across all drive types compared to the previous year, totalling 307,460 units. Germany, one of the EU’s core markets, saw a 12.2% drop (from 88,240 units in 2024 to 77,431 units in 2025).

Bus registrations in the EU, however, increased by 7.5% to 38,238 units, with Germany (+28% year-on-year) emerging as a key driver. The trend is clear: fossil-fuelled internal combustion engines are losing ground at the EU level, as registrations of battery-electric trucks and buses continue to rise. However, the starting points differ significantly: electric buses are already well-established, while battery-electric trucks remain relatively rare.

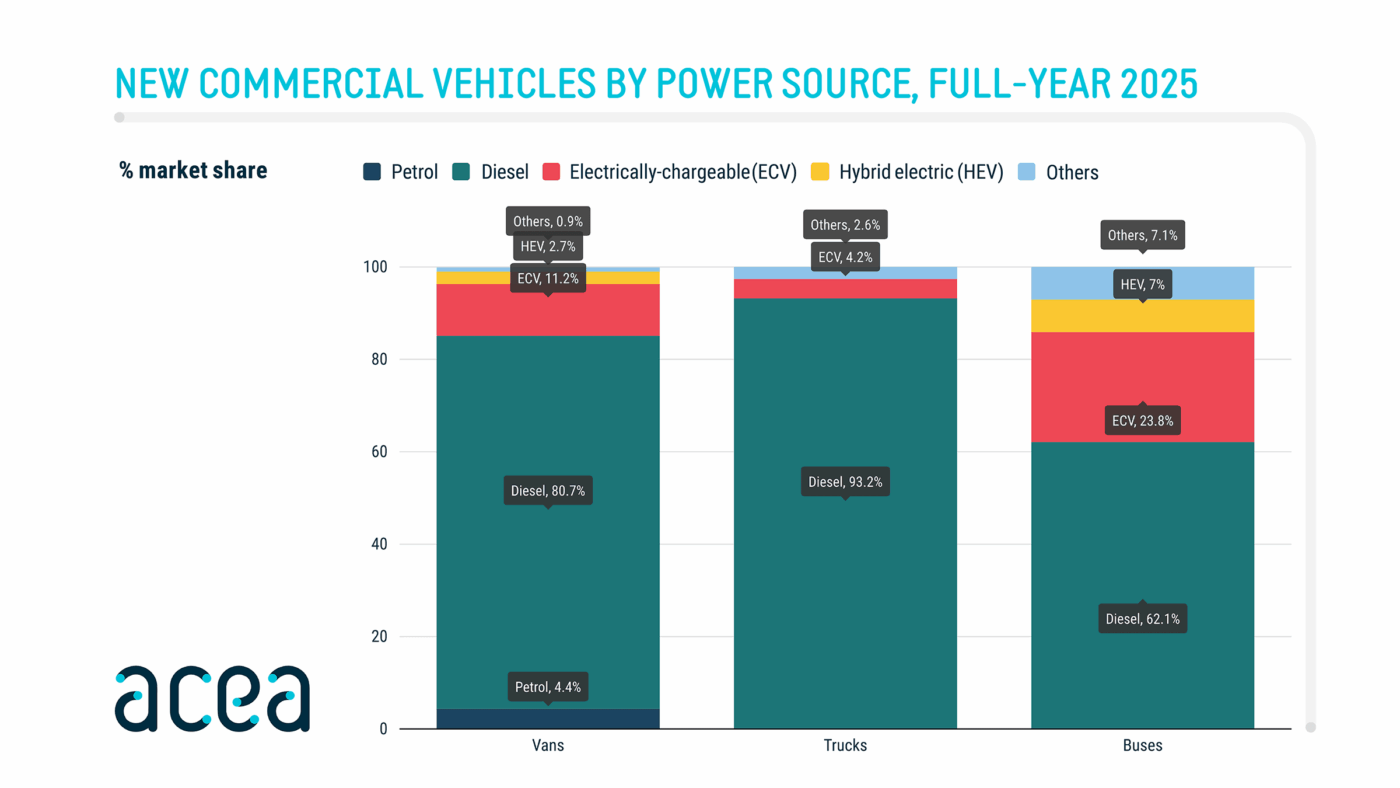

A closer look at the details reveals that plug-in trucks accounted for 4.2% of total registrations in the annual balance—up from 2.3% in the previous year. When including EFTA countries (Iceland, Liechtenstein, Norway, and Switzerland) and the UK, their share rises to 4.8%. In the more mature electric bus market, battery-electric vehicles now make up 23.8% of all registrations in the EU. Including EFTA countries and the UK, the share of battery-electric buses climbs to 25.9%. In other words: one in four new buses in Europe is now electric.

ACEA does not report purely electric commercial vehicles separately

Before examining the country rankings in detail, a brief clarification of terms is necessary. In the truck sector, ACEA categorises its statistics by weight classes. The association classifies trucks weighing between 3.5 and 16 tonnes as medium-duty trucks, while those over 16 tonnes are considered heavy-duty trucks. Vehicles under 3.5 tonnes fall into the van category, which is not the focus here. For buses, ACEA does not differentiate by weight classes; instead, it includes all vehicles intended for passenger transport weighing over 3.5 tonnes. Additionally, the association does not distinguish between purely battery-electric vehicles and plug-in hybrids, grouping them under the term ‘electrically-chargeable.’

Focusing on medium-duty trucks between 3.5 and 16 tonnes, it is evident that demand in this segment declined by 9.9% across the EU. In 2025, only 52,972 new units were registered, but this included 7,867 plug-in vehicles, representing an impressive year-on-year increase of 87%. As a result, externally chargeable trucks in this weight class now account for 14.8% of registrations. This demonstrates that medium-duty battery-electric trucks were the primary driver of electrification in the European truck market in 2025.

Germany alone registered 3,368 medium-duty battery-electric trucks, accounting for 43% of all newly registered electric trucks in the EU. However, Germany’s growth rate of 40% was below the EU average. The highest growth rates were recorded in the Netherlands (1,147 units, +523% year-on-year), Sweden (619 units, +407% year-on-year), and Italy (521 units, +174% year-on-year). France added 852 medium-duty battery-electric trucks (+33% year-on-year), while Denmark registered 470 units (+122% year-on-year). These nations lead the segment. Outside the EU, the UK is Germany’s closest competitor, with 2,562 electric trucks of up to 16 tonnes (+56% year-on-year).

Germany remains EU frontrunner in heavy electric trucks

Heavy trucks over 16 tonnes dominate the EU market by volume. Out of approximately 254,488 total registrations (-5.4% year-on-year), 4,991 were battery-electric trucks, representing a 2% share. Germany once again stands out, with 1,398 units (+38% year-on-year), thanks in part to a strong finish in the fourth quarter. That means that 28% of all heavy battery-electric trucks in the EU were registered in Germany in 2025. Countries with above-average growth in this segment included Austria (405 units, +143% year-on-year) and the Netherlands (878 units, +83% year-on-year). France saw a modest increase of 28%, registering 861 units.

Switzerland deserves special mention in the battery-electric truck sector. The small Alpine nation registered 942 electric trucks over 3.5 tonnes (+64% year-on-year) in 2025, achieving an electric share of 21.3%—the highest in Europe. Notably, heavy battery-electric trucks performed particularly well in Switzerland (524 units, +71% year-on-year). The Netherlands follows as the only other country with a comparable electric truck share, reaching 18.2% thanks to around 2,000 new plug-in units. Norway, a leader in electric passenger cars, achieved a 16.9% share of battery-electric trucks in 2025.

Diesel remains the dominant drive type

The flip side of this trend is that diesel engines maintained their dominant position in the EU market for medium and heavy-duty trucks in 2025, accounting for 93.2% of new registrations. Their numbers declined by 8% year-on-year, slightly below the overall market decline of 6.2%.

Let’s take a closer look at the European bus market. Here, the adoption of battery-electric vehicles has long been established. Of the 38,238 new buses registered in the EU (+7.5% year-on-year) between January and December, 9,089 were electrically chargeable, representing a 23.8% share. This marks a significant increase, as the electric share stood at 18.5% in 2024. While the electric bus market in the EU grew by an average of 39%, Germany (1,808 units, +106% year-on-year) stood out in 2025, supported by strong growth markets such as Sweden (898 units, +262% year-on-year), Belgium (737 units, +234% year-on-year), and the Netherlands (784 units, +92% year-on-year). Smaller EU nations like Portugal (235 units, +198% year-on-year) and Lithuania (222 units, +196% year-on-year) also deserve mention. In contrast, Spain and Finland saw declines (-22% and -54% year-on-year, respectively).

Hybrid buses lose popularity

Another notable trend is that externally chargeable buses are increasingly overshadowing hybrid buses. According to ACEA, hybrid bus registrations in the European Union fell by 25%, reducing their market share to 6.9%. Meanwhile, diesel bus registrations saw a slight increase in 2025, bringing their market share to 62%.

The electric bus sector presents a more homogeneous picture across the EU compared to battery-electric trucks. Fifteen of the 27 EU member states reported three- or four-digit electric bus registrations in 2025 —led by Germany (1,808 units), Italy (1,371 units, +17% year-on-year), and Sweden (898 units). On a pan-European level, the UK remains the undisputed leader in electric bus registrations. In 2025, the country registered 2,856 new plug-in buses (+56% year-on-year), acting as a key driver in pushing the electric bus share across the EU, EFTA, and UK to a record 25.9%.

ACEA summarises the year as follows: “The EU’s commercial vehicle market had a challenging year in 2025, with registrations falling across several major markets, a clear sign of the tough economic environment. The bus segment was the only exception.”

0 Comments