German carmakers behind the curve in electric cars

With the impressive Porsche Taycan, German engineers have shown all their skills. It proves that continued inaction is the highest risk for German domestic brands. At the same time, outdated vehicle designs remain electric top sellers.

* * *

The Taycan is a Porsche through and through. More filigree than the baroque Panamera and with the highest quality finish. Precise, perfect and dynamic. The Taycan is not only fast on the drag strip, but also in curves. It is almost absurd how it hugs corners with rear-wheel steering and active roll compensation.

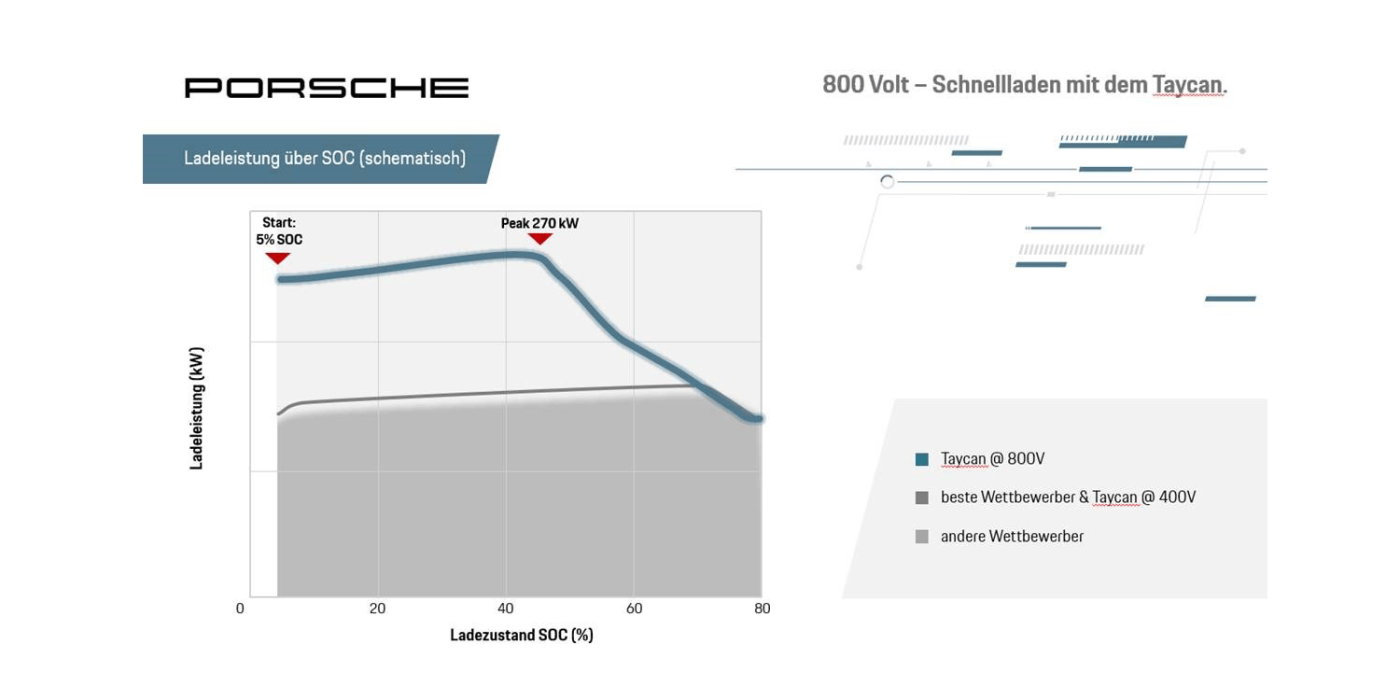

And if the charge power indicator on the DC column continues to rise at 250 kilowatts (kW), it becomes clear: resistance is futile. This car is awesome. The price starts at 105,607 euros, for the Taycan Turbo with several options are starting at €175,483.80 – yet Porsche continuously caters on a luxury market so there will be clients.

Luxury or not, the Taycan is an outstanding electric car and a testament to the skill of German engineers. It is both a reminder and an incentive: either the domestic car industry will promptly introduce further models at this level of engineering. Or it will lose market share worldwide to those who act. Anyone who opts for Tesla once will not come back so quickly. Tesla’s trump card is and will remain its unique position in many segments. For example, there is simply no alternative to Model 3, so the question arises: Germany, where are you, where are your top electric cars?

Volkswagen under pressure?

The greatest concern in this respect is currently with Volkswagen. It is noticeable that the number of new registrations of e-Up and e-Golf has been particularly high since the beginning of the year, and the discounts on list prices are the same. Volkswagen needs these battery-electric cars because they will enter the CO2 fleet balance as double zero in 2020: So-called supercredits ensure double crediting.

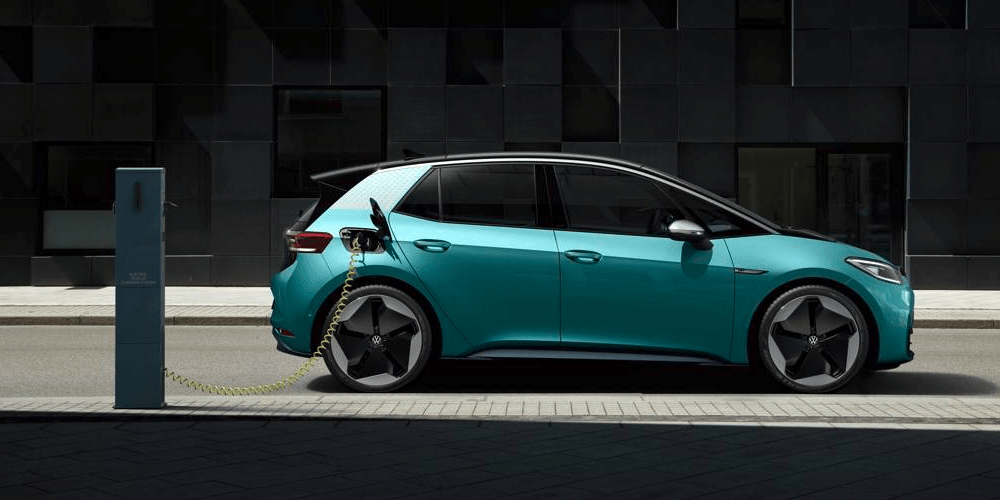

One would assume that ID.3 could take over this task from late summer, but despite all denials, doubts are growing. Perhaps the software problems are bigger than previously communicated. And anyway: If the European market collapses – how many ID.3 will still be needed to compensate for the average CO2 values of the entire fleet? Probably a few less. The launch of ID.3 is also a credibility test. Last we received signals that the e-Golf is to be produced until the beginning of November. This does not inspire confidence.

The Wolfsburg-based group is at the beginning of a severe crisis. The production ramp-up of the Golf 8 is not going as well as desired. Only 8,392 units were built in 2019. It is the best-selling car in Europe, but something is wrong. Works council chairman Bernd Osterloh names “overzealous board members who tried to stuff too much technology into a car” as the cause. An apparent confirmation of the thesis that bits and bytes are not working in Germany.

Toyota has a safer EV strategy

The Golf 8 is stuck, the production start-up of the ID.3 is viewed with suspicion, and the biggest disaster is China, where the market slumped by 75 per cent in February – the Volkswagen Group sells 40 per cent of its total production there. The most massive threat after the replacement of the Beetle by the Golf and the takeover by Ferdinand Piëch in 1993 has officially arrived.

The only way out is to take a determined path into the future, and that path bears the abbreviations ID.3 and ID.4. But there is not even a price list or a configurator to play out the fantasy. The Volkswagen Group is publicly on the offensive when it comes to battery-electric cars: the target is 1.5 million units in 2025. However, according to today’s sales figures, this only represents a share of around 15 per cent. And if we compare this with Toyota, the Japanese giant that allegedly thinks nothing of the BEV, Volkswagen’s ambition is put into perspective – with roughly the same total sales, Toyota is planning to sell a good one million units by 2025.

BMW and Mercedes still a long way off

The fact that Tesla has blatant weaknesses in service and complaints about fluctuating quality is of secondary importance to buyers. Besides Porsche and Volkswagen, BMW and Mercedes could also build first-class electric cars – but so far this remains in the realm of theory and conjuncture.

At the Geneva Motor Show, or what was left of it, BMW presented another pre-version of the i4. Finally, a competitor to the Tesla Model 3, if it weren’t for a set launch in 2021 – without the month. And Mercedes has a whole armada of promising prototypes, from the EQB compact SUV to the EQS and EQE sedans. In series, however, only the Smart is available and, oh yes, the EQC, of which 109 units hit the road in February.

Audi has awakened – almost

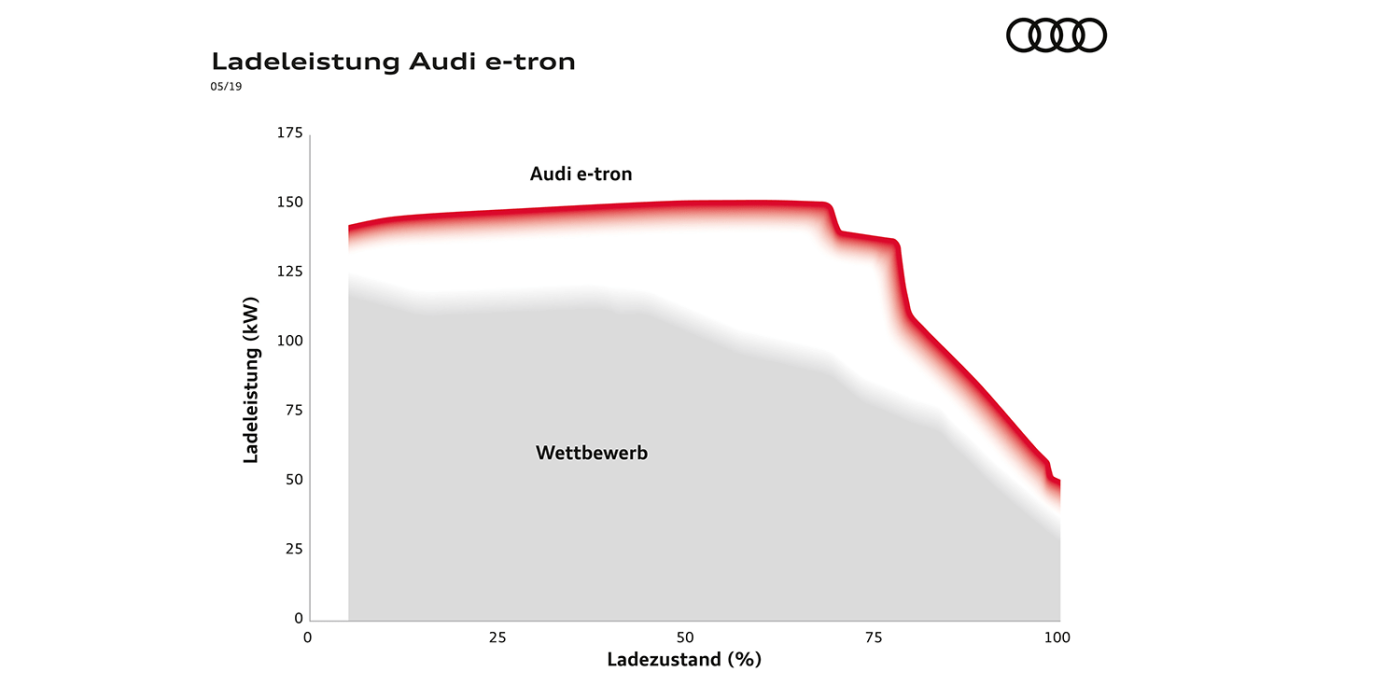

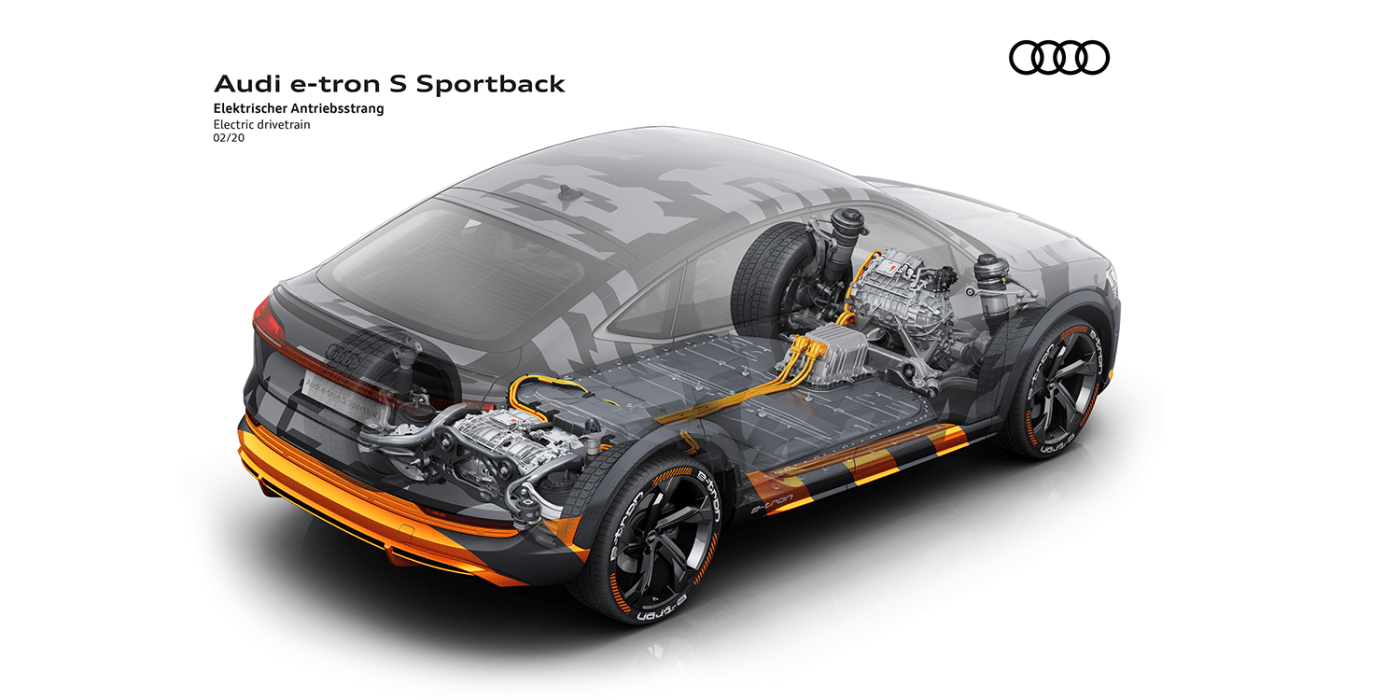

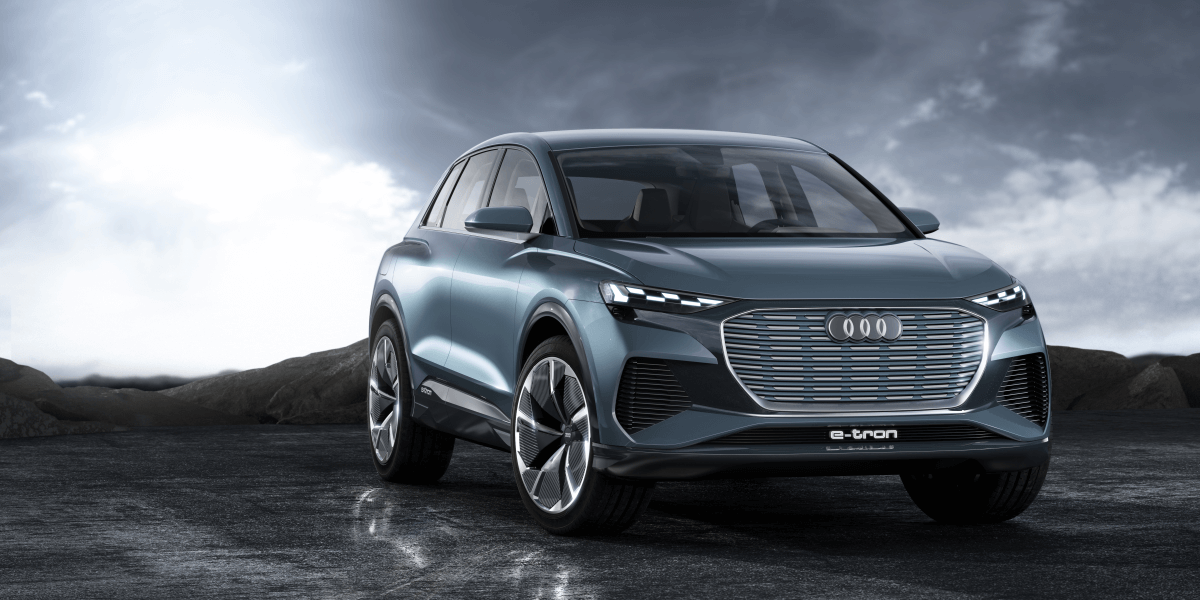

At Audi, the realisation that the market is shifting and requires adaptation has taken hold. In addition to the e-tron quattro, which offers the most stable temperature management of all electric cars, Audi offers the e-tron Sportback. Even more importantly, sales of the e-tron S will begin in the summer with two e-machines on the rear axle, which ensure perfect torque vectoring. At Tesla, this is called Plaid drive, and so far it is merely an announcement by Elon Musk. The modern Quattro presents the first ray of hope for the company slogan Vorsprung durch Technik (German for progress through technology). This is to be followed by the e-tron GT based on the Porsche Taycan and the Q4 e-tron as the first MEB model from the Ingolstadt-based company.

It is a general shame that already outdated designs such as Renault Zoe, Volkswagen e-Golf and BMW i3 remain among the top sellers, and even Tesla Model S and Model X are off the Raven drive of yesterday. Besides, battery systems without active temperature management are offered too often – electric cars are, in many cases, a technical residual ramp.

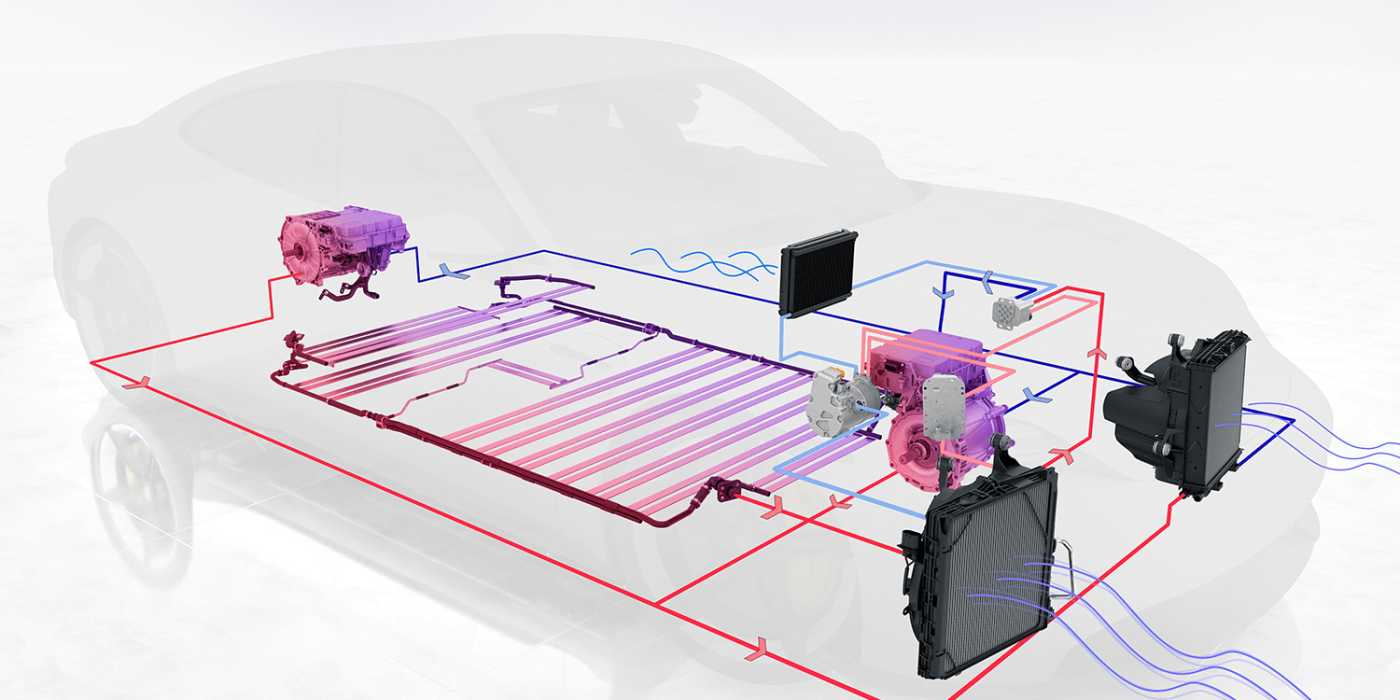

Back to the Porsche Taycan. For the success of the battery-electric car, it is essential that the entire concept is outstanding and not just individual aspects. The Taycan embodies this. In the economic crisis, the view should be wide open and directed forward. And for German industry, in the shape of the BMW Group, Daimler AG and Volkswagen AG, this means a mandate to work even harder to build the best electric cars in the world. In this decade, the battery-electric drive is an addition to the combustion engine. Listless participation is no longer enough. Or, to say it with Mercedes: Build the best or nothing.

Reporting from Christoph M. Schwarzer, Germany.

0 Comments