Tesla’s sales battles over Q2 slow profits

For the second quarter of the year, Tesla has steadily followed its income trend: the US electric carmaker’s second-quarter 2023 revenue nearly reached $25 billion, but at the same time, the company posted its lowest operating margin in a long time at 9.6 per cent.

Both metrics from the Q2 financials are a testament to Tesla’s aggressive pricing tactics, which are boosting sales but throttling profitability through reduced average vehicle prices. The American manufacturer generated $24.93 billion in revenue between April and June ($21.27 billion of which came from its automotive division). Compared to the second quarter of 2022, the revenue is up by 47 per cent, and the company also increased compared to the first quarter (23.33 billion dollars). The nearly 25 billion dollars also exceeds the previous best quarterly result in the final quarter of 2022, when Tesla achieved its previous sales record of 24.32 billion dollars.

Tesla sees healthy operative margin

The GAAP result from the second quarter showed the US company posting an impressive 2.7 billion dollars in profit over the past three months. That is 20 per cent more than in Q2/2022 (2.26 billion dollars) and also more than in Q1/2023 (2.51 billion dollars), but the result does not quite reach the second half of 2022 which showed quarterly profits well above the 3 billion dollar mark. The same applies to the operating margin: between April and June, it dropped to 9.6 per cent, having already fallen from 16 to 11.4 per cent in the previous quarter. The slump is a foregone conclusion: Tesla has accepted the falling operating margin as a result of the global price cuts initiated at the beginning of the year.

In its annual report, Tesla speaks of an “operating margin of around 10 per cent, which has remained healthy despite price cuts in Q1 and early Q2”. This reflects Tesla’s own cost-cutting efforts, production increases in Berlin and Texas, and the strong performance of its other business divisions. As in the previous quarter, the company explains the reduced profitability mainly with the reduced average vehicle price, but also with high investments in the ramp-up of the 4680 cell production and the production preparations for the Cybertruck. Only a few days ago, the Texan branch of the company announced the production of the first Cybertruck.

Tesla’s other models are currently the main revenue generators: 19,489 units of the Model S/X were built in Q2 and 19,225 vehicles were delivered. Both series are still only being manufactured at Tesla’s plant in Fremont, California. Between April and June, 460,211 units of the mid-range Model 3/Y series rolled off the assembly line around the globe, with 446,915 units being handed over to customers. Across all model series, Tesla produced 479,700 vehicles and delivered 466,140, marking an increase of 38,892 and 43,265 units, respectively, compared to the previous record quarter Q1/2023.

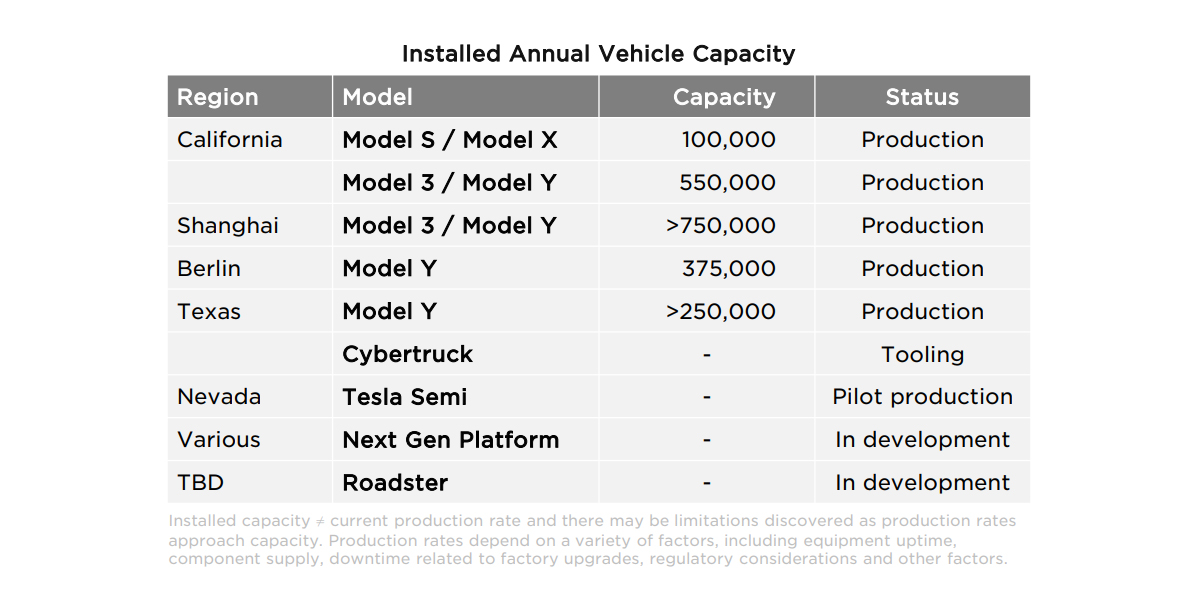

Shanghai proved to be the company’s most productive plant, with 750,000 vehicles produced, followed by Fremont with a total of 650,000 vehicles. Next came the Berlin factory, which hit a production record of 375,000 vehicles, which is an impressive 125,000 units than just six months ago. The gigafactory in Austin, Texas produced 250,000 units.

Cybertruck deliveries to launch in 2023

In terms of future prospects, Tesla says that preparations for the Cybertruck are on schedule. The electric car manufacturer has announced not only production but also initial deliveries for this year. The Semi is already in its early production phase but is not ready for mass rollout quite yet.

Tesla’s annual report does not comment on the announcements published in the so-called ‘Master Plan 3′ in April, such as the planned plant in Mexico, the new models and the next-generation platform. With one small exception: the manufacturer writes that it is “continuing to make progress with the next-generation platform”. At least it is ready to talk: the Americans not only want to reach the production target of 1.8 million units for 2023, which was made public six months ago, but they want to exceed it. They expect to be “above this mark”, they say. Halfway through, Tesla has already built 920,508 vehicles and delivered 889,015.

It was also a question whether Tesla would comment on the broad adoption of Tesla’s NACS charging technology in the US on the occasion of the Q2 results. The answer is definitely yes – and in relative detail. The American manufacturer writes that the second quarter of 2023 was “the quarter of Supercharging”. Tesla added that a significant number of companies, including Ford, GM, Mercedes, Nissan, Polestar, Rivian, Volvo and Electrify America, had officially joined in on the rollout of NACS.

NACS as a potential profit driver

In its annual report, Tesla classifies this statement on NACS in the category “Services and Other business”, which makes it clear what the manufacturer was alluding to above with the strong performance of this business area: namely, among other things, the revenue that the NACS adoption by other manufacturers brings into the company’s coffers.

Meanwhile, Tesla has continued to expand its Supercharger charging network – as well as its network of stationary locations. The number of Superchargers increased by around 33 per cent in the past quarter (to 5,265 locations worldwide with 48,082 charging points), the number of service centres rose by 29 per cent to exactly 1,068 locations and the “mobile service fleet” increased by 22 per cent to 1,769 vehicles.

With reporting by Cora Werwitzke, Germany.

ir.tesla.com, tesla.com (PDF)

0 Comments