Contracts confirmed: EU funds five battery projects with 640 million euros

In July, the European Commission selected six battery projects for funding, earmarking a total of €852 million in grants from the Innovation Fund. Most of the budget was thus already allocated. However, the European Climate, Infrastructure and Environment Executive Agency (CINEA) has now signed funding agreements with only five project sponsors. As a result, the cumulative subsidy amount dropped to 643 million euros. The reason is that Cellforce has withdrawn its application. The project has been put on ice as part of a major restructuring initiated by Porsche, including job cuts at the subsidiary.

The other five projects are scheduled to go into operation between 2027 and 2029. The grants follow the first Innovation Fund call for batteries, launched in December 2024. The call, named “IF24 Battery” and worth one billion euros, is part of a larger package totalling 4.6 billion euros intended to support European flagship projects in net-zero technologies, electric-vehicle batteries and renewable hydrogen.

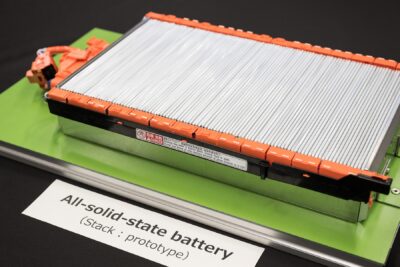

Applications in the battery category were accepted until April. The funding aims to promote innovation in electric-vehicle battery production, including sustainable manufacturing techniques, processes and technologies. “The selected projects represent strategic investments that will support Europe’s transition to a clean, competitive, and resilient industrial base, reducing at the same time the dependence on imports and fostering the development of clean technologies, and industrial leadership,” the Commission stated in the summer.

Two of the six projects are based in France and directly linked to the country’s automotive industry: ACCEPT (“Automotive Cells Company European Production Take-off”) comes from Automotive Cells Company (ACC), the battery joint venture of Stellantis, TotalEnergies and Mercedes-Benz, which already operates a cell plant in Douvrin. The new development involves five production lines for NMC cells at two sites in France with a combined capacity of 15.7 GWh. This is bad news for Germany and Italy: ACC had planned additional cell factories in Kaiserslautern and Termoli, but both have already been put on ice. The focus now appears to be shifting entirely to France.

The second French project, AGATHE (“Advanced Gigafactory Aiming at Tempering greenhouse gases Emissions”), comes from Renault’s battery partner Verkor. With EU funding, Verkor plans to double the capacity of its Dunkirk cell factory from eight to 16 GWh – although the plant had originally been announced with 16 GWh. High levels of automation, the use of artificial intelligence and an on-site “pre-recycling” facility are intended to cut production costs and improve sustainability.

One German project made the list

Germany initially submitted two projects, neither directly linked to major automotive manufacturers. After Cellforce’s withdrawal, only the WGF2G (“Willstatt GigaFactory 2 GWh”) project remains. It is backed by Swiss company Leclanché, which intends to expand its German production to 2 GWh. The project focuses on industrialising Leclanché’s sustainable, PFAS-free production process. The water-based procedure with PFAS-free electrodes can be used for both NMC cells (with significantly reduced cobalt content) and LFP cells. The water-based binders replace highly toxic solvents previously used in the production process – the Swiss company had already announced this plan in 2023.

Next is Sweden: the NOVO One project is intended to support the Novo Energy battery cell factory. Novo was originally a joint venture between Northvolt and Volvo (hence the name), but Volvo has already taken full ownership following Northvolt’s insolvency. However, the Swedish manufacturer has yet to present a new battery-industry partner for the planned cell factory in Gothenburg, and 150 jobs were cut in May. The prospects for this project currently appear unclear, at least publicly. The Commission states that the projects were “selected by independent experts based on seven evaluation criteria”, including “potential to reduce greenhouse-gas emissions”, as well as “operational, financial and technical maturity” and “contribution to EU security of supply and cost efficiency”. The experts therefore appear to view Novo Energy’s future positively.

With the 46inEU project (“Powering the Future – 46 Cylinders, Infinite Possibilities in Europe”), LG Energy Solution aims to ramp up production of 46-millimetre cylindrical cells in Poland. Such high-volume cylindrical cells are increasingly used in electric vehicles but are still produced mainly outside Europe. BMW’s Neue Klasse will be the first EV platform with 46 mm cells to roll off a European assembly line – with more expected to follow. LGES plans to produce 85 million of these cells, equivalent to 11.5 GWh.

Other projects still have a chance

According to the Commission, the funding will not be paid out in a single instalment but will be released when specific project milestones are met. The support will cover both investment and operating costs, with part of the funding available before commissioning to support the investment phase. A total of 14 applications from eight countries were submitted under “IF24 Battery”. The current decision to back five projects does not mean that the others will necessarily miss out: “Other promising but not yet mature projects” may receive project development assistance from the European Investment Bank.

1 Comment