What is behind the success of electric buses in the UK

After three years of decline, the UK market for buses of all drive types grew strongly again in 2023. According to statistics from the Society of Motor Manufacturers and Traders (SMMT), there were 4,932 new registrations last year, 45 per cent more than in 2022. What’s really remarkable is that zero-emission buses (ZEB) accounted for almost half of all new large buses. According to SMMT data, 45.1 per cent of new registrations of single and double-decker buses were either battery-electric or hydrogen-powered.

With this in mind, let’s take a look at the different bus types in the SMMT statistics: the new registrations for 2023 differentiate between 2,378 minibuses (+18% YoY), 1,610 solo buses (+52.5%) and 944 double-deckers (+173.6%). Excluding minibuses, there were 2,554 single and double-decker standard buses, of which around 1,150 had a purely electric drive (BEV or FCEV). That is the 45.1% market share mentioned above.

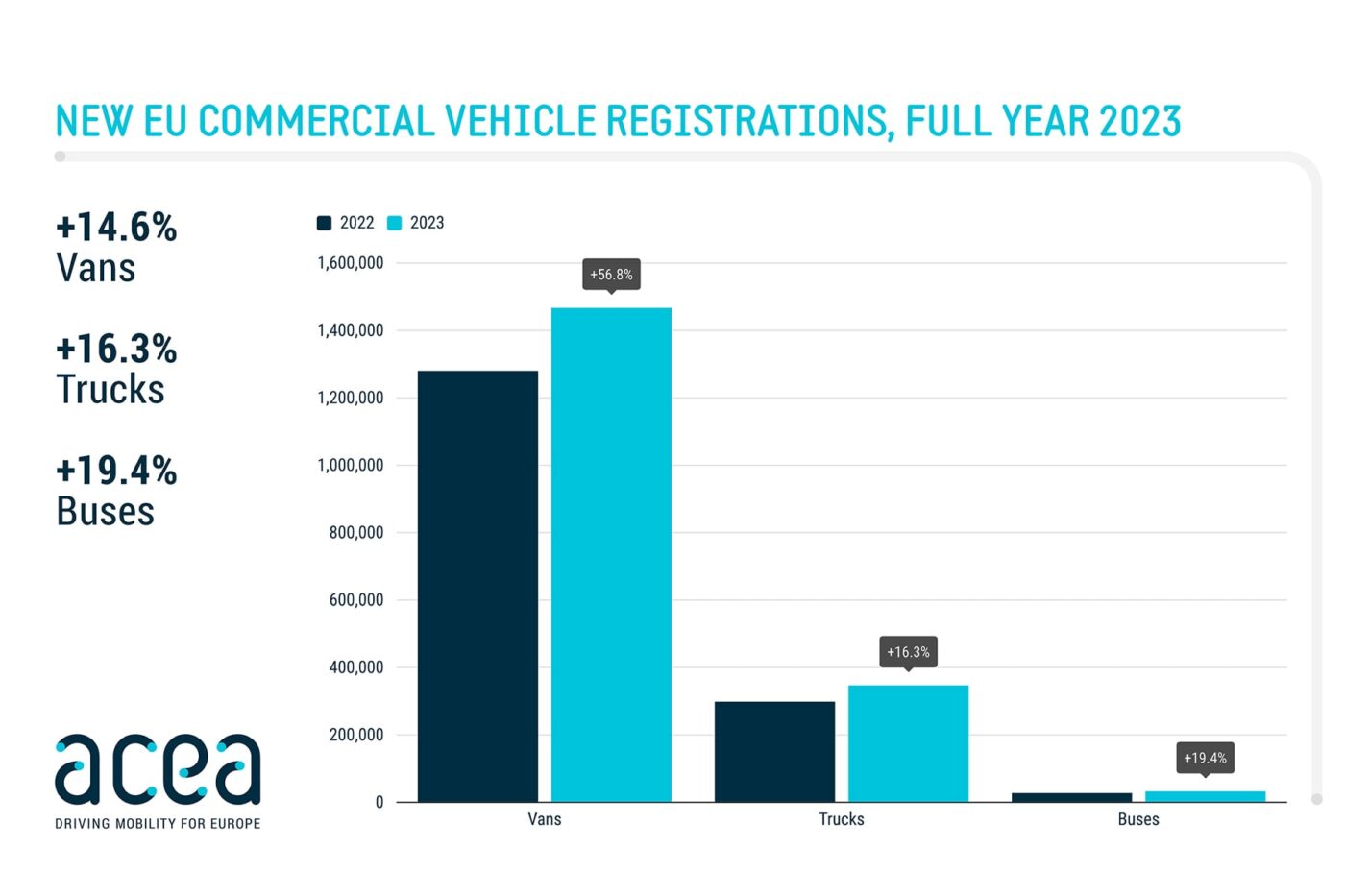

This is by far the top position in Europe. According to recently published figures from the European Automobile Manufacturers’ Association (ACEA), Germany was the second-largest market with 835 electrified buses (+29.3% YoY), including all buses from 3.5 tonnes and even (the rather rare) plug-in hybrids. Incidentally, 1,314 new e-buses are listed for the UK under these criteria, which corresponds to a growth rate of 69.3 per cent compared to 2022.

European electric bus ranking

The other European nations with the most e-bus registrations according to ACEA criteria (again: BEVs and PHEVs from 3.5 tonnes are shown together here) include France (743, -4.9%), Norway (563, +84.6%), Spain (525, +270%), Italy (410, +253%) and Portugal (385, +502%).

But back to the UK. Ford (1,011 units), Mercedes (968), Alexander Dennis (517), Wrightbus (482) and BYD (444) lead the manufacturer ranking across all drive systems. The statistics are not broken down by bus type and drive type. But Ford does not have any “fully-fledged buses” in its portfolio. The 1,000 or so units are, therefore, minibuses. BYD only sells zero-emission vehicles in the UK, making the 444 buses belonging to BYD in the statistics BEVs. In the case of Mercedes, Alexander Dennis and Wrightbus, the given volumes are likely to be a mix of drive systems.

The high proportion of battery-electric and fuel cell buses in the UK is guaranteed by the so-called ZEBRA (Zero Emission Bus Regional Area) funding as part of the national strategy ‘Bus Back Better’ published by the British government in March 2021. In November 2023, the current government presented an interim report, according to which an estimated 4,200 zero-emission buses have now been subsidised. The ZEBRA 1 programme was followed up last year with ZEBRA 2 and a new budget of £129 million (around €151 million) for financial years 23/24 and 24/25. The government has also been supporting the bus industry since March 2020. As of November, the support is expected to amount to over £2 billion (equivalent to €2.34 billion).

The government bears 75% of additional costs compared to diesel

All British local transport authorities outside London can apply for ZEBRA 2 funding. Priority will be given to those who have not previously received funding. 25 million pounds (currently around 29 million euros) has also been earmarked for rural communities. The subsidy per vehicle amounts to up to 75 per cent of the additional costs compared to standard diesel buses. In the case of infrastructure, the state will cover up to 75 per cent of the investment costs incurred for the purchase and installation. Transport companies can also apply for grants to cover up to 50 per cent of any “unforeseen costs” for vehicles and infrastructure.

Mike Hawes, SMMT Chief Executive, comments on the development in the UK: “Britain’s bus sector is recovering strongly, powered by rising passenger numbers and government funding that is finally delivering new vehicles to routes up and down the country.” In his view, zero-emission buses are on the verge of becoming the mainstay of what is now the largest ZEB market in Europe “[…] but we need the next round of funding – fast – to put even more on the road.”

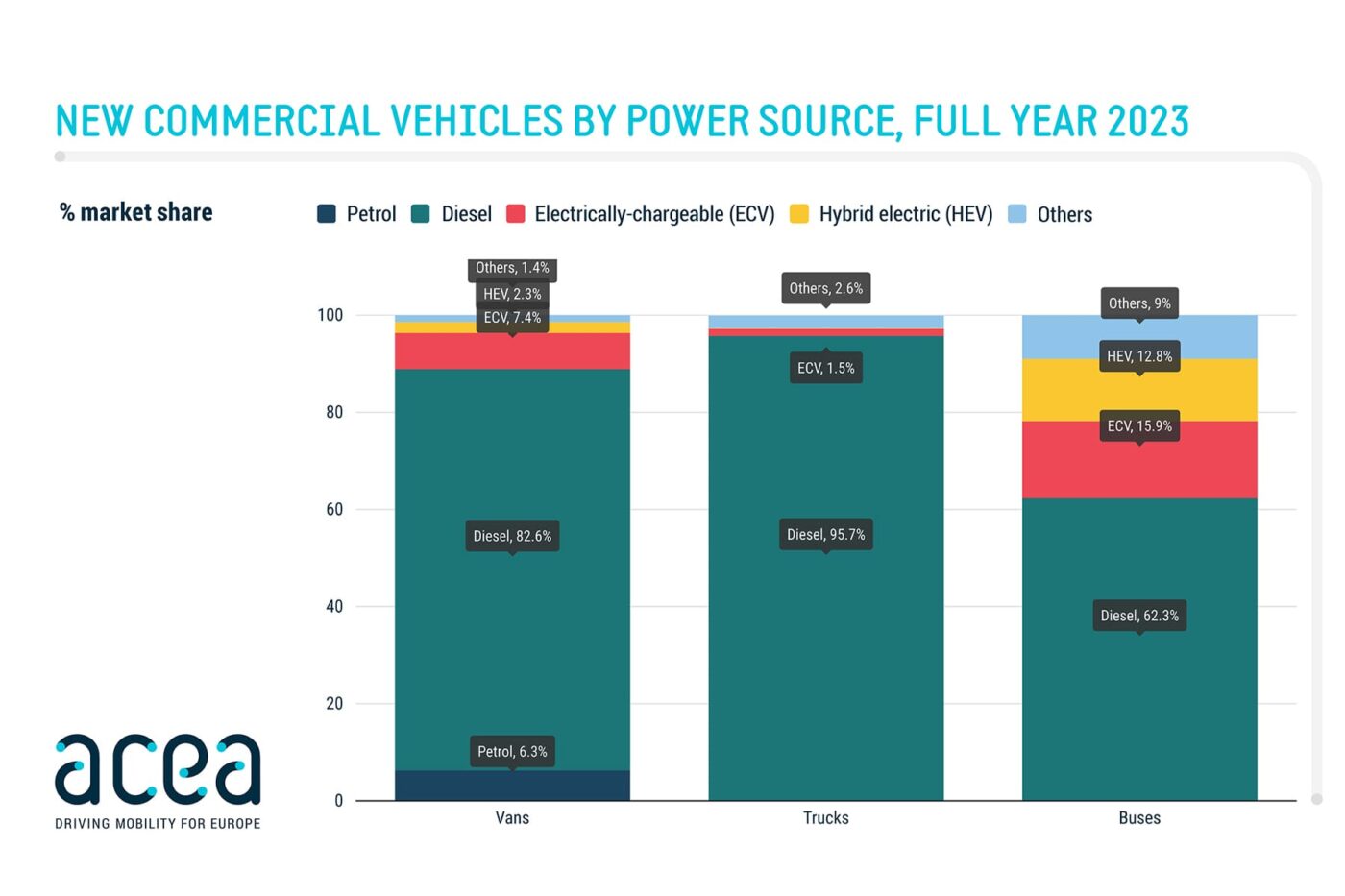

A broader look at the commercial vehicle sector shows that the transition for trucks in the UK is taking off less dynamically. According to ACEA, 1,220 medium-duty and 286 heavy-duty trucks with BEV or PHEV drive systems were registered in Britain in 2023. A growth of 82 and 107%, respectively, compared to 2022, is behind Germany (1,560 medium-duty and 609 heavy-duty electrified e-trucks). For electrified vans up to 3.5 tonnes, the UK ranks behind France (30,277) but ahead of Germany (20,798) with 22,269 new registrations.

An interesting side aspect: in the UK, drivers with a conventional driving licence are allowed to drive emission-free vans weighing up to 4.25 tonnes thanks to an exemption. However, this does not apply to minibuses, which are often based on vans. A similar regulation is not planned until 2025. Critics see this as a reason for the BEV momentum still lagging behind in this segment in the UK. “Bringing this date forward would boost demand, as many minibus fleets are delaying their investment in zero-emission vehicles until their existing drivers are allowed to drive these vehicles,” says the Society of Motor Manufacturers and Traders.

0 Comments