Hyundai’s electric strategy – two prongs to success?

German and European car manufacturers are currently fully committed to the battery and still very hesitant regarding the fuel cell. Toyota is doing it the other way around. Hyundai wants to develop both technologies in parallel. A closer look at what the Koreans have in mind.

“Finally, we have a chance to become technology leaders, not followers. We should take this opportunity.” No car manager who wants to convince their board of directors of a costly investment has said these words. Instead, they came from South Korea’s President Moon Jae-in, who wants to secure his country a ten per cent share of the global electric car market by 2030.

Of the 60 trillion won (just under 47 billion euros) that South Korean companies are to invest in the car technologies of the future over the next ten years, the Hyundai-Kia Group accounts for the bulk of these. And it goes without saying in South Korea, that Moon expects a large part of this money to be invested in the development of fuel cell vehicles: The government sees hydrogen as a green and promising industry for the future. In this way, one can not only become a global player in the automotive industry but also in green energy supply.

560,000 BEVs by 2025

Hyundai itself states that it intends to invest around 35 billion euros in “future mobility solutions” by 2025. This will not only lead to the development of fuel cells but also, in the short term, battery-electric cars. By 2025, the Hyundai brand alone intends to launch 16 BEV models on the global market, not including its subsidiary Kia. With the Ioniq Elektro and Kona Electric, there are two models so far. In the target year 2025, 1.67 million electrified vehicles are to be sold, of which more than 560,000 are battery-electric cars.

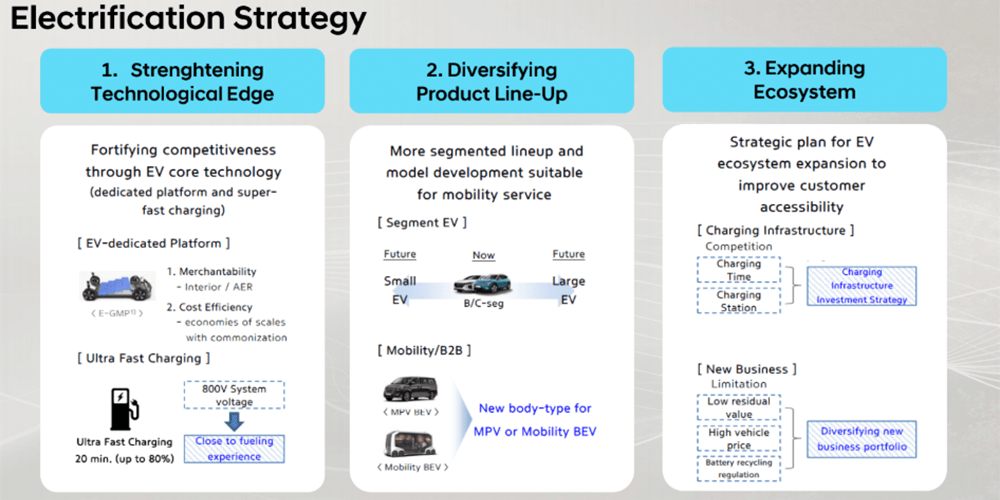

Hyundai already gave an outlook on their battery-electric future at the IAA. The “45” concept is said to have been more than just a concept car; the angular design of the brand’s battery-electric models should be retained, as electrive learned in several discussions with Hyundai managers. But above all technically the “45” should be a pioneer: The production model derived from this, which is to be launched on the market as early as 2021, will be based on the new Electric-Global Modular Platform (E-GMP). The E-GMP is a dedicated electric platform, similar to the Volkswagen MEB – the Koreans want to use it to generate noticeable cost advantages thanks to the economies of scale. However, there is still no information on how modular E-GMP will be or which vehicle segments Hyundai can cover with it.

Hyundai platform based on 800 Volt

However, E-GMP has one major advantage over the MEB: it is based on an 800-volt system. For this reason, Hyundai also joined the Ionity fast-charging joint venture in September. This makes higher charging capacities and shorter charging times possible. Should Hyundai manage to bring charging capacities of well over 200 kW into the volume segments without exceeding the price range, this would be a major market advantage. For the time being, Volkswagen will continue to use the 400-volt system for its MEB models and will thus be limited to charging capacities of up to around 150 kW.

As shown in a presentation by Panos Kefelakis, Deputy General Manager Product/Cross-Carline at Hyundai Motor Europe, the announced 16 BEV model series will significantly expand the range. “We are planning electric models that are bigger but also smaller than the Kona and Ioniq,” says Kefelakis. “However, it has not yet been decided on which platform the respective models will be based.”

However, it is unlikely that a small car in the A-segment will be based on the E-GMP with the 800-volt system for cost reasons. Kefelakis did not want to comment on whether this would be a smaller electric vehicle platform or a multi-energy platform such as the Kona and Ioniq.

Still, Hyundai does not only want to electrify limousines and SUVs. The market for mobility services and the B2B segment in particular have their requirements in terms of body shape. For example, a fully electric van for taxi or ridesharing services is possible. In a small graphic, Kefelakis even shows a “Mobility BEV” that, as an autonomous mobility platform, is reminiscent of concepts such as the Rinspeed Snap or Toyota’s e-pallet.

The plans for the fuel cell are much more concrete than for the self-propelled van. Hyundai, for example, announced a further car with hydrogen technology for “2020+” in addition to the Nexo series model, but the future of the fuel cell also lies in commercial vehicles. As the Group announced in August, seven battery-electric and ten fuel cell commercial vehicles are to be launched on the market by 2025 – from vans and trucks to buses.

Demand for H2 trucks already present

In Europe, the H2 truck project in Switzerland will make a start. Next year, the first 50 Hyundai H2 Xcient trucks built in Korea will be deployed in Switzerland, with 1,600 trucks by 2025. The H2 truck, with its range of around 400 kilometres, will not be freely available on the market, for the time being, although Hyundai managers report that there is already serious interest from the market.

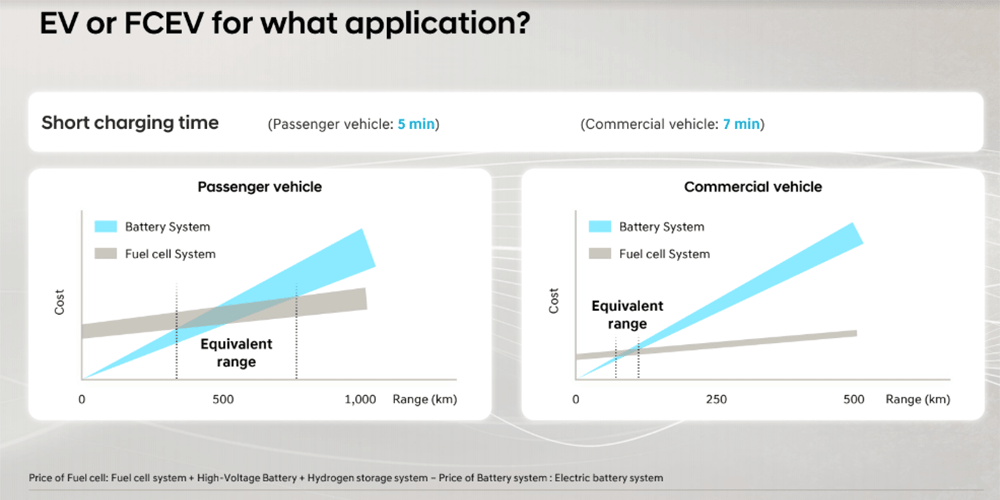

Hyundai did not want to comment on whether and when further BEV and FCEV commercial vehicles would come to Europe. However, the increased use of fuel cells in commercial vehicles seems likely, as Hyundai sees clear cost advantages for hydrogen compared to batteries in commercial vehicles with ranges of more than 100 kilometres and more. The situation is different with passenger vehicles: there is a relatively large range between 400 and 700 kilometres, in which Hyundai FCEV and BEV see roughly the same costs. At lower ranges, the battery is cheaper, at higher ranges the fuel cell is more cost-effective. “We believe that the fuel cell can become something like the diesel of the future, while BEV will rather replace the gasoline engine,” says Kefelakis.

For this forecast to materialise, a great deal still needs to be done in the area of hydrogen infrastructure. Hyundai is working with Hydrospider, a joint venture between Alpiq, H2 Energy and Linde, on the Swiss use of H2 trucks. Hydrospider will produce green hydrogen, store it and deliver it to filling stations. Alpiq’s two-megawatt electrolysis plant is scheduled to go into operation in January – but it will only supply hydrogen for 40 to 50 trucks. For the 1,600 lorries and thousands of fuel cell cars, a lot has to happen not only in Switzerland but throughout Europe.

>> Reporting by Sebastian Schaal

0 Comments