Renault plans to cover the entire BEV value chain

Renault is accelerating its electric strategy and has presented a comprehensive strategy package under the name ‘Renault Eways Electropop’. This not only includes new sales targets, but also further details on the French company’s platform and technology strategy.

Renault Group’s new sales targets for Europe are 65 per cent electrified vehicles by 2025 and up to 90 per cent purely electric vehicles by 2030. Previously, the target included hybrids (PHEVs and HEVs) in the 90 per cent of electrified vehicles by 2030, so the change to 90 per cent BEVs represents a significant tightening here.

Ten new electric models are planned by 2030, seven of them under the Renault brand, three as Alpine. In the future, Renault will rely on standardised battery cells for new BEV models in all segments in order to reduce costs at pack level by 60 per cent by 2030. The latter is to be achieved by 2030 with the introduction of a solid-state battery, which is to cost only 80 dollars per kilowatt-hour, at the same time, liquid electrolyte batteries are also expected to become much cheaper.

“Today is a historic acceleration of Renault Group’s EV strategy and for ‘made in Europe’,” says Renault chief Luca de Meo. He extrapolated that the recently announced construction of Renault ElectriCity is “not just a symbol, but a strategic decision,” claiming that the merging of three factories will make the resulting facility the largest and most competitive eMobility complex.

But the company’s own electric production is not to be limited to the three vehicle plants of Douai, Maubeuge and Ruitz of Renault ElectriCity: The recycling plant called ReFactory will be located in Flins, and the electric drive systems will be manufactured at the Cléon plant in Normandy. The French company also wants to manufacture power electronics in-house.

To this end, Renault has recently initiated and decided on a number of important developments: For cost reasons, the Renault Group – much like Volkswagen – is relying on a unit battery cell. Depending on the intended use, this can be equipped with a low-cost cell chemistry for the A and B segments or with a performance-oriented composition for the C segment and the sporty Alpine models.

No LFP batteries for the Renault 5

Renault will use NMC cells with a nickel-manganese-cobalt cathode. According to rumours, an LFP battery was also being discussed for the Renault 5. At the ‘Eways’ event, however, Renault experts emphasised that NMC cells were favoured because NMC cells would offer the better price-performance ratio. These cells would not only age better, but also offer a better residual value when recycled.

The affordable cells are to be used for the first time in the Renault 5. The manager in charge, Sophie Schmidtlin, mentioned a WLTP range of 400 kilometres and a cost of $85 per kilowatt-hour at module level as target values. These cells will be manufactured at Envision AESC’s recently announced factory to be built in Douai.

Performance cells will continue to be supplied by long-time battery partner LG Energy Solution. The Gen1 version will be used for the first time in the new electric Mégane and is expected to provide a range of 450 kilometres at 60 kWh according to WLTP. Schmidtlin did not mention prices here, but indicated that the Gen2 version should reach an energy density of 700 Wh/l from 2024. A leap in charging power is then planned for 2026: Schmidtlin speaks of 4C, which would correspond to a charging power of 240 kW with a battery size of 60 kW. The charging process from 15 to 80 per cent should then only take 12 minutes.

Focus on battery life cycles

Special high-performance batteries are to be developed and produced in cooperation with Verkor; Renault wants to buy at least ten GWh per year here. In its partnerships with LGES and Envision, too, de Meo says it is not just a simple customer, but a partner. “We have the data of over 320,000 electric cars on the road, in the last twelve months alone we have collected 300 terabytes of battery data,” the Renault CEO said. “That is the largest battery data set of any car manufacturer in Europe.” He added that the company now wants to use this experience in development.

As development boss Gilles Le Borgne points out, the battery still accounts for 40 per cent of the cost of a battery-electric car. “That’s why it’s crucial for us to control the cost of batteries in order to be able to offer affordable and competitive BEVs without compromises,” says the developer.

Another adjusting screw is the electric drive itself, even if it only accounts for ten per cent of the vehicle costs. As before, the core here is an EESM, i.e. an electrically excited synchronous machine without permanent magnets. Among other things, this concept is to be made more efficient with hairpin windings in the stator.

The biggest factor in the drive, however, is the power electronics, which account for up to two-thirds of the costs in this area. In the course of the cooperation with STMicroelectronics, the power electronics for the electric cars will be developed and manufactured – in France, as Renault emphasises.

Integrated drive unit to reduce costs

By 2025/2026, these developments are to be brought together in a new all-in-one unit: Electric motor, reduction gearbox, 800-volt-capable power electronics, AC-DC converter, DC-DC converter and the onboard charger will then be combined in one housing. As a result, the new drive unit should not only require 45 per cent less space, but also generate 45 per cent less energy losses. A reduced price is also a factor, since the unit is to be 30 per cent cheaper, which today is virtually equivalent to the cost of the electric drive itself.

In parallel, an axial flow motor is being developed together with the start-up Whylot – so far, only Ferrari uses such a motor in the SF90 Stradale in the car industry. Renault initially intends to install these engines in hybrid and plug-in hybrid vehicles, but later also plans to use them in battery-electric models.

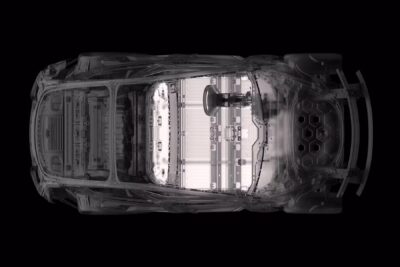

Renault’s electric transition with the ten new models is supported by two platforms: the CMF-EV from the Renault-Nissan-Mitsubishi alliance for the C and D segments, and the CMF-BEV for smaller and more affordable vehicles such as the Renault 5. In the smaller CMF-BEV, not only are the acoustics to be significantly improved, but functions such as Plug&Charge are also to be introduced.

In Renault’s live online event announcing the new targets, it was not said exactly how many of the seven Renault BEVs will be based on the CMF EV and how many on the CMF BEV. What is clear, however, is that another retro model will be coming alongside the Renault 5: De Meo showed the silhouette of a small panel van, as well as the headlight graphics of a model that would probably be called ‘Renault 4ever’ internally – a clear allusion to the R4.

With reporting by Sebastian Schaal, Germany.

renaultgroup.com, press conference via webcast

1 Comment