JATO: Chinese brands overtake Tesla in Europe in February

Compared to the previous year, the 164,148 EVs in February represent an increase of 26 per cent. As total registrations fell by 2.5 per cent to 966,271 new cars over the year as a whole, BEVs achieved a market share of 17 per cent – 3.8 percentage points more than in February 2024. In addition, there were 72,639 plug-in hybrids (+1%) with a market share of 7.5 per cent.

According to JATO Dynamics, it is the best February for BEVs we have seen yet. Together with January, electric car registrations in Europe stand at 329,700 units, a whopping 31 per cent up on the previous year.

It is important to keep an eye on the development of the e-mobility market when looking at JATO’s analysis of individual manufacturers and models. The market experts devote four paragraphs of the press release to (former) market leader Tesla. The US company’s market share fell to 9.6 per cent in February, and this year it is as low as 7.7 per cent – down from 18.4 per cent in January and February 2024.

“Tesla is experiencing a period of immense change. In addition to Elon Musk’s increasingly active role in politics and the increased competition it is facing within the EV market, the brand is phasing out the existing version of the Model Y – its best-selling vehicle – in anticipation of the introduction of a new refreshed version,” says Felipe Munoz, Global Analyst at JATO Dynamics. “During this process, brands often experience a drop in sales before they return to normal levels, once the updated model becomes widely available. Brands like Tesla, which have a relatively limited model lineup, are particularly vulnerable to registration declines when undertaking a model changeover.”

In February, Model Y registrations fell by 56 per cent to 8,800 units, while Model 3 registrations fell by 14 per cent to 6,800 units. “The difference in volume drops between these two vehicles suggests that the decline in the brand’s overall sales is more firmly rooted in the Model Y changeover than Musk’s political activity. However, it will be interesting to see to what extent demand rebounds once the new Model Y hits markets across the region,” Munoz adds.

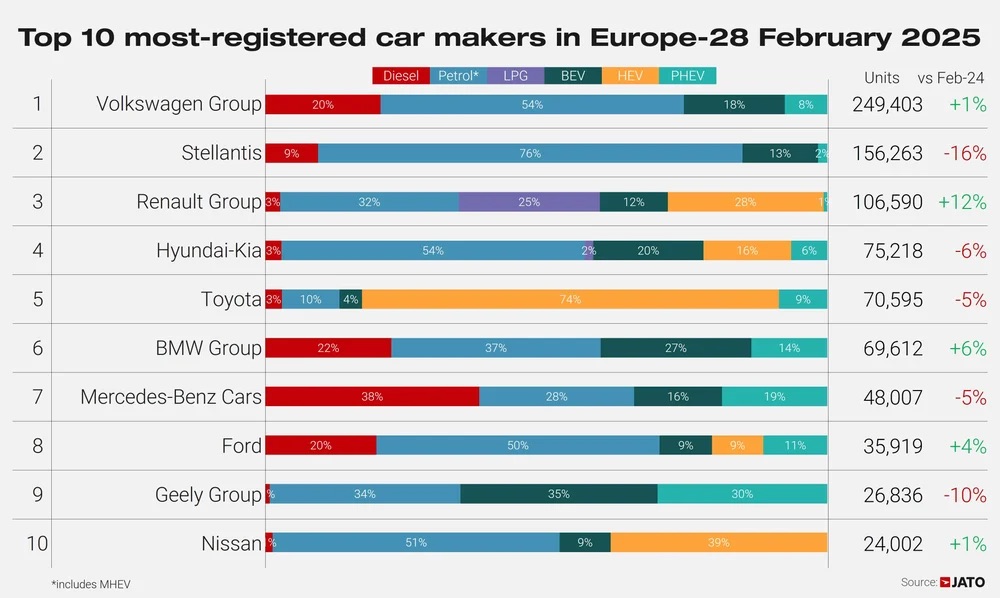

Among electric car manufacturers, Tesla has moved to second place with 15,737 units – behind the Volkswagen brand, which was able to increase EV sales by a whopping 180 per cent to 19,565 units. The following brands, BMW (13,475 BEVs, +20%), Audi (9,868 BEVs, +70%), Renault (9,387 BEVs, +96%) and Kia (8,153 BEVs, +56%), were also all up significantly. At BMW, 27 per cent of total sales were battery-electric, at Hyundai-Kia the figure was 20 per cent, 18 per cent at the VW Group, 16 per cent at Mercedes-Benz and 13 per cent at Stellantis.

With a 35 per cent BEV share, the Geely Group still stands out. Overall, Chinese car brands registered 19,800 new electric vehicles in Europe in February, overtaking Tesla with just over 15,700 units. In the same month last year, 23,182 cars from Chinese brands were registered, compared to 28,131 Tesla vehicles. However, JATO also counts Volvo as a ‘Chinese-owned car brand,’ as it is owned by Geely. With 6,656 BEVs, Volvo just makes it into the top ten. BYD follows in 15th place (4,436 BEV), and Polestar (2,405) and MG (2,205) in 20th and 21st place. Behind them, Xpeng just makes it into the top 25 with 1,034 units – Leapmotor, with around 900 new registrations, does not.

Among the top 25 models, only the Volvo EX30, with 3,314 units, appears as a ‘Chinese’ brand according to the JATO definition. However, the Tesla Model 3 (6,834 new registrations) is also only built in China for Europe. With the Dacia Spring (17th place, 2,934 new registrations) and Cupra Tavascan (19th place, 2,456 units), there are more electric cars produced in China on this list. The top five are led by the Model 3, followed by the Model Y (8,790) built in Germany, the VW ID.4 from Zwickau and Emden (6,172), the new Renault 5 with 5,659 new registrations and the ID.7 from Emden with 5,432 units.

However, with a decline of 56 per cent, Model Y has fallen out of the top ten best-selling models across all drive types – the hurdle in February was 13,889 units of the Toyota Yaris Cross in 10th place. The Dacia Sandero is the best-selling car in Europe with over 21,000 new registrations – with an almost perfect 50: 50 split between petrol and diesel. The Citroën C3 is in second place – with a respectable 28 per cent electric share.

0 Comments