ICCT ranking on the electric transition: China’s OEMs are pushing to the top

Since 2023, the ICCT has presented an annual manufacturer assessment of the electric drive transition, drawing on data from the six major global markets of China, Europe, India, Japan, South Korea and the USA. According to the study makers, these regions account for 82 per cent of all global car sales. The 21 manufacturers (the world’s largest in terms of sales) analysed by the ICCT in its third rating accounted for a total of 90 per cent of sales in these six markets in 2024.

The ICCT assesses the performance and strategy of the 21 car manufacturers with regard to the electric transition (BEVs and FCEVs) based on a number of criteria relating to their current position in the market, their technological performance and their strategic vision for future decarbonisation. Specifically, the ICCT drew up ten specially developed key figures to compare the manufacturers and, according to its own information, used independent information collected up to the end of 2024. In the current report, a new indicator for green steel, an updated indicator for battery recycling and reuse and a revised methodology for assessing the actual operation of plug-in hybrids in China are used for the first time. However, according to the authors, comparability with the two previous years is still ensured.

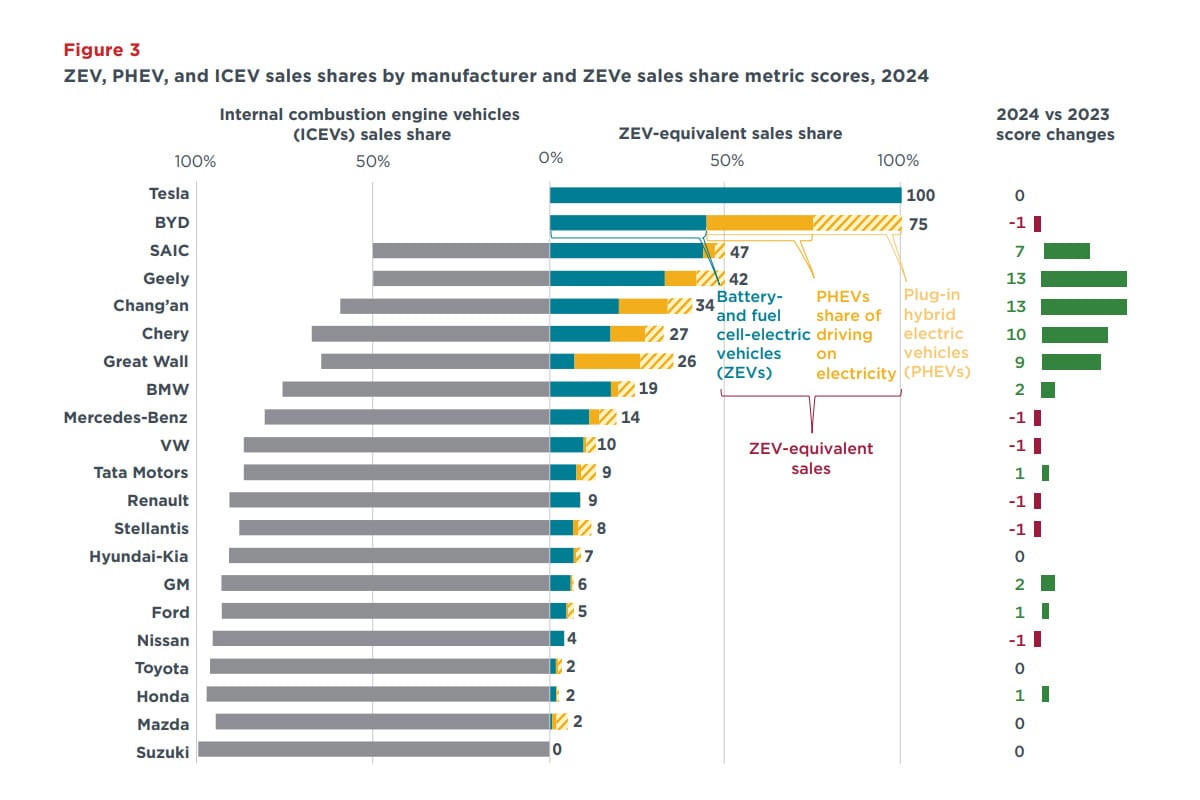

The new analysis shows a growing gap between China-based car manufacturers, which are expanding their lead in the electric vehicle market, and leading European car manufacturers, which are increasingly struggling to keep pace. This is reflected in the overall ranking from third place onwards, with Tesla and BYD claiming the top two spots, as in the 2023 report. Both are still regarded as ‘leaders’. And both scored exactly the same number of points as a year earlier – BYD was therefore unable to catch up.

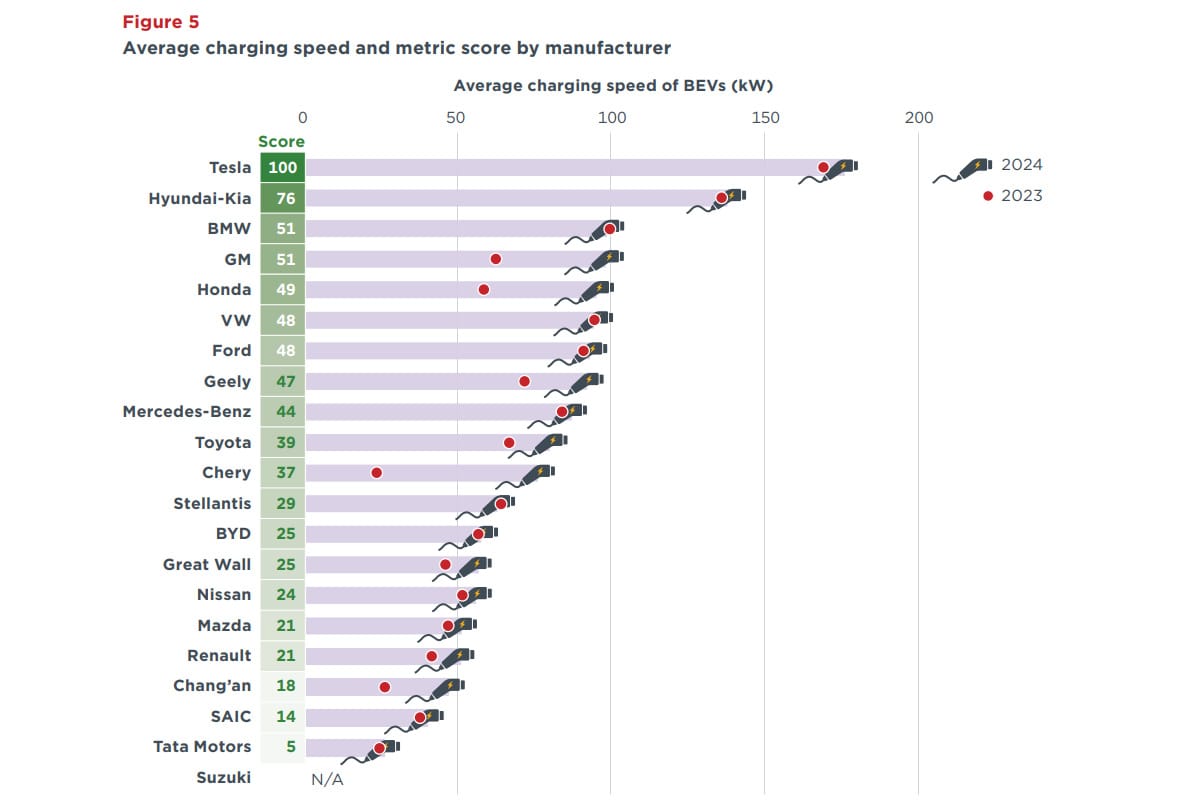

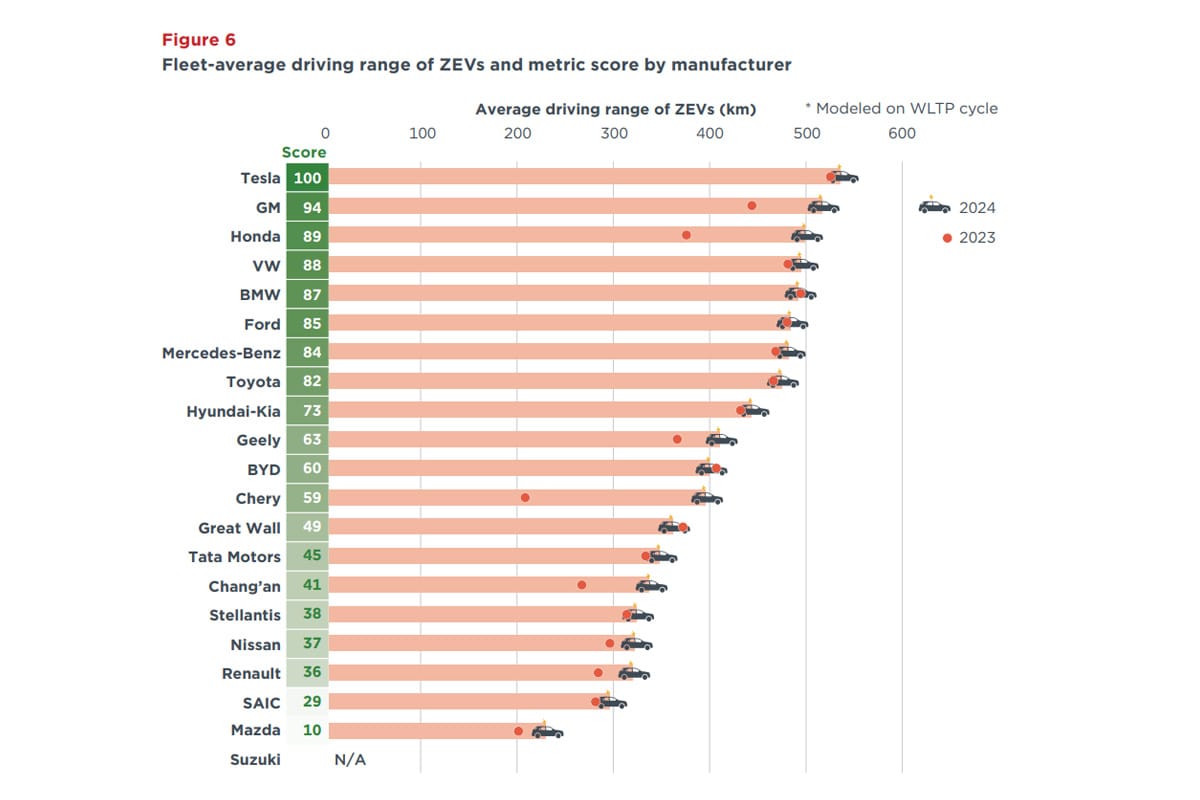

Although BYD sold more battery electric cars than its competitor Tesla for the first time in 2024 and continued its expansion in the six markets surveyed (BEV sales increased by 25 per cent, BEV and PHEV sales together by 47 per cent), BYD also lost ground in other criteria – such as fleet energy consumption or range. Tesla was therefore able to defend its top position, although sales stagnated in 2024 compared to the previous year.

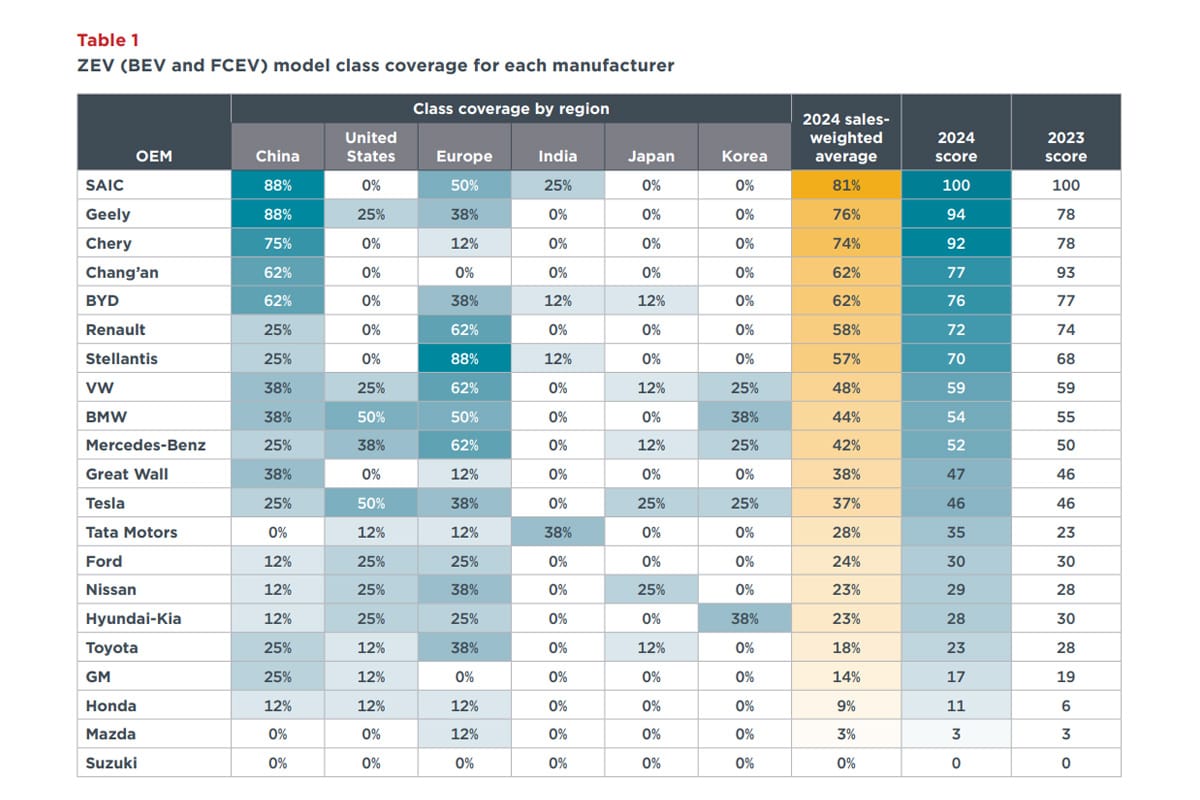

Only one other manufacturer in the ranking – Renault in the midfield – had an identical score, while the ICCT ratings of 14 OEMs improved, although four companies also performed worse than in 2023. Chinese manufacturers were among the main winners: Geely and Chery, both in the ‘Transitioners’ group (the midfield), showed the greatest improvements. The duo increased their sales shares, introduced new models and placed greater emphasis on high-performance models that improve the average performance of their new BEV fleets. The result: Geely (together with SAIC) displaces last year’s third and fourth-placed BMW and Mercedes-Benz. Chery is also making a big leap forward: in 2023, the manufacturer was still close to the edge of the stragglers; in 2024, it is in the centre of the midfield. Stellanti’s VW and GM are also still in the upper midfield – as is another competitor from China, Changan.

The major automakers based in Japan and South Korea continue to lag behind, according to the ICCT ranking, but Honda and Nissan are making progress: “Honda introduced its first BEV model, the Prologue, in the United States, and its sales led to substantial improvements in all BEV performance metrics for the company. Nissan strengthened its ZEV ambition by separating its 40%

by 2030, ZEV target from a previously announced target that included conventional hybrid vehicles.”

In the ICCT’s three-year analysis to date, Tata Motors is the first car manufacturer to advance from ‘laggard’ to ‘transitioner’. Because: “In 2024, Tata introduced new EV models that diversified its offerings. Tata and subsidiary Jaguar Land Rover also ramped up efforts in battery recycling and repurposing in

major markets.” Tata’s rise was in turn Hyundai-Kia’s undoing. The OEM fell among the ‘laggards’ in the current assessment, “partly because it has not disclosed progress on battery recycling and repurposing.”

In general, the ICCT report states that electric vehicles will account for almost 20 per cent of global passenger car sales in 2024 (up to 3.8 tonnes in the USA and 3.5 tonnes in other markets) – the highest sales share to date. Absolute sales also continued to climb: from 2022 to 2023, the jump in global EV sales was 26 per cent and from 2023 to 2024, marking another 27 per cent. “There is remarkable momentum behind electrification,” summarise the authors.

However, many OEMs had expected an even faster transition. This resulted in a collective row back in 2024: Ford, Tata Motors, Dacia (part of Renault), Mini (part of BMW) and Volvo Cars (part of Geely) “rolled back or cancelled their ZEV targets,” writes the ICCT. Only Changan and Hyundai-Kia slightly increased their targets for electric vehicles. As mentioned, Nissan initially announced a BEV target adjusted for hybrids. Furthermore, “None of the 21 automakers significantly increased their ZEV investments in 2024.” However, according to the ICCT, car manufacturers are increasing the transparency of their strategies and supply chains.

theicct.org, theicct.org (PDF, report)

0 Comments