IAA Mobility 2025: China dominates, Germany shines

For the first time since rebranding – and the move from Frankfurt to Munich – the name IAA Mobility 2025 is fully justified. Once dominated by Audi, BMW, Mercedes and co, IAA has truly evolved from a pure car show into a forward-looking mobility fair. While petrolheads were the focus a few years ago, this year’s edition clearly prioritised e-mobility, autonomous driving and innovative mobility solutions.

The combustion engine is becoming obsolete

In the current transitional phase, combustion engines still play a role on the exhibition floor. The VW T-Roc and Renault Clio, two of Europe’s most popular models, were presented in fully refreshed versions, both conventional petrol vehicles. Hybrid drives represent the highest level of electrification for these bestsellers. At the IAA Summit, the professional visitor area, the share of electric vehicles was likely at least 80 per cent.

That also proves that the debate reignited by Markus Söder, Prime Minister of Bavaria, about abandoning the so-called combustion engine phase-out is nothing more than hot air and populism. German Chancellor Friedrich Merz, in a speech at the opening of the mobility fair, also called for more leeway on combustion engines. “We are fundamentally committed to the switch to e-mobility, of course, but we need more flexibility in regulation,” the Chancellor said.

While suppliers sometimes hold back, German carmakers are convinced of the need to fully electrify their model line-ups. Even though Porsche emphasised the combustion engine again due to the still limited demand for electric sports cars, BMW CEO Oliver Zipse repeatedly advocated technological openness, despite strong EV sales. While Mercedes CEO and ACEA Chairman Ola Källenius may have called on the EU Commission in an open letter to relax the “combustion ban,” the long-term trend in southern Germany is clearly electric.

Thomas Schäfer, Volkswagen’s brand chief, went on the offensive and openly contradicted Söder at IAA Mobility. In his view, battery-electric drive is ultimately unavoidable for decarbonisation. This position is reinforced by the latest study from the International Council on Clean Transportation (ICCT). According to the ICCT, European carmakers are on track to meet the 2027 CO2 targets, driven by rising electric vehicle sales.

China was omnipresent at the fair

This fresh focus on future mobility seems to have been well received by the industry. According to VDA Managing Director Jürgen Mindel, one-third of the 2025 exhibitors participated for the first time. At the same time, the fair has become significantly more international. This year, around half of the 750 exhibitors came from abroad. A total of 38 countries were represented, mainly from Asia. The majority of the international exhibitors were from China, with 116 Chinese companies showing their portfolios.

A large share of visitors also came from China. This indicates that it is no longer Europe or the US, but China that has become the centre of the global automotive industry. The country not only controls the battery supply chain but also leads globally in production volumes.

Other car nations largely absent

The omnipresence of Chinese companies is also due to the absence of many manufacturers from other European countries. For example, the Stellantis group was represented only by Opel and Leapmotor, while its French and Italian subsidiaries skipped the fair. The automotive giant, formed from the merger of PSA and Fiat-Chrysler, manages the European distribution of the Chinese brand Leapmotor via a joint venture. Opel’s presence was modest: the German carmaker showcased a concept car for the racing game Gran Turismo and the Mokka GSE, the 206 kW sporty version of its electric crossover. Leapmotor presented the sleekly styled B05 compact EV – though its windows were still taped shut.

The Japanese automotive industry attaches little significance to IAA Mobility. Neither Toyota, Honda, Nissan, Subaru nor Mazda attended the fair. Only a supplier Aisin and a few smaller companies had stands at the Summit. Meanwhile, only Lucid was present from the US. The Californian EV manufacturer used the event to launch the Gravity in Europe. The SUV impresses technologically and in terms of space, but its high prices above €100,000 and its still-developing brand image are likely to limit success in Germany.

Togg enters the German market

Meanwhile, Turkey is establishing itself as a car nation. The EV manufacturer Togg, founded in 2018, celebrated its German market launch at the event, with official order books opening at the end of September. Alongside the SUV T10X, already available in Turkey, the newcomer unveiled the conservatively styled T10F hatchback sedan.

The company’s press conference attracted significant interest, reflected in extensive online coverage. Among Germany’s large Turkish community, the EVs – equipped with contemporary technology and modern software – resonate strongly. If prices remain reasonable, the expansion into the German market could prove successful.

BYD’s first estate is a plug-in hybrid

At the last IAA Mobility in 2023, there was talk of Chinese EVs flooding the European market. In Germany, however, sales from automakers from China remain modest. Only SAIC’s subsidiary MG has managed to establish itself quickly, thanks to comparatively low prices and a familiar name. BYD, the industry giant, had a much rockier start, leading to a complete restructuring of its European leadership and a 180-degree shift in sales strategy after just two years.

The new strategy quickly bore fruit. In Q1 2025, BYD sold 2,791 vehicles in Germany, a 385 per cent increase compared with the previous year. Due to punitive tariffs on Chinese EVs, BYD now focuses more on plug-in hybrids in the EU. Its only new launch at the show was its first estate – a body type popular primarily in Europe. The BYD Seal 6 DM-i Touring is a plug-in hybrid with a combined range of up to 1,350 kilometres, according to the company.

Xpeng pushes charging performance

Xpeng had a prominent presence both on the Open Space and on the exhibition grounds, emphasising its innovation. The Chinese partner of VW not only showcased the letters K and I but also displayed the futuristic second generation of its flagship P7. The P7 Gen 2 is expected to be available in Germany from early 2026. The five-metre fastback sedan is not just elegant but also packed with technology: it features an 800-volt electrical architecture, an impressive peak charging capacity of 486 kW, a Chinese standard range of 820 kilometres, modern AI features and an 87-inch head-up display.

Although Xpeng’s models have been sold in Germany for only around two years, the company has also upgraded its two SUV models, the G6 and G9. The key change: the underfloor battery will now use LFP cells instead of NMC. Engineers were able to extract record-breaking charging performance from the new battery packs and modernised hardware. The Tesla Model Y competitor G6 achieves peak charging of up to 451 kW, while the larger G9 reaches up to 525 kW. Both vehicles can charge from 10 to 80 per cent in just 12 minutes under ideal conditions.

Nio continues to focus on luxury and advanced technology

Nio continues to emphasise high-tech features in its models. The Chinese premium competitor was not directly present at the show or the Open Space, but its European headquarters in Munich organised a press event during IAA Mobility to present its new flagship, the ET9, to a European audience. The demonstration of the active hydraulic suspension left a lasting impression and was among my personal highlights of this year’s IAA.

The system, called “Skyride”, was developed by US startup Clearmotion and consists of four suspension struts that adjust in real time to road irregularities. This eliminates at least 75 per cent of body movements. Clearmotion’s solution makes its production debut in Nio’s EQS rival. During the event, stacked and filled champagne glasses were placed on the ET9’s bonnet. The car drove over an artificial bump course without spilling a single drop.

The ET9 impresses with its aerodynamic fastback design, luxurious rear cabin and innovative technology. However, it is highly doubtful that a 5.33-metre-long luxury saloon, priced well above €100,000, will significantly boost Nio’s minimal sales in Europe. That is likely why Nio has not yet announced a launch date for the local market. The brand’s limited appeal has previously prevented notable market share even in the mid-range segment; in the top-end market, success currently seems highly unlikely.

Changan, GAC and Hongqi push for expansion

Just in time for IAA Mobility, additional Chinese automakers are entering European markets. Hongqi, one of the oldest carmakers from China, is venturing further into Western markets. The models presented range visually from kitsch to bland. The Hongqi SUV EHS5 bears a striking resemblance to its domestic competitor, the Deepal S07.

The Deepal S07 is now also available in Germany. Changan launched its sub-brand Deepal with two SUV models, the S05 and S07. Styling is overseen by former VW chief designer Klaus Zyciora. In Germany, the Deepal S05, priced at just under €39,000 and competing with the VW ID.4, appears to have the greatest potential. At the show, I had the chance to take the S05 for a spin – and based on first impressions, the Chinese brand has produced a solid compact SUV.

A limited understanding of the local customer base

The two EVs with which the state-controlled manufacturer GAC (Guangzhou Automobile Group) aims to make its mark in Europe left a mixed impression. The mid-range SUV Aion V, priced from at least €35,990, made a decent impression, while the VW ID.3 rival Aion UT, set to follow in 2026, reinforced many common stereotypes about Chinese cars.

The relatively inexpensive interior materials and the design clearly inspired by its Wolfsburg competitor are still forgivable, but the overly soft suspension and completely numb steering are less so. At higher speeds, the compact EV did not feel particularly safe. One can only hope that, as announced, the manufacturer makes further improvements before the European launch.

Incidentally, the voice control on both models responds to “Hey Baby” – an embarrassing detail that symbolises the fact that Chinese automakers still partly fail to understand European customers and their tastes. This is also reflected in the sometimes questionable videos and cheap-looking graphics on the exhibition stands.

Nonetheless, it is impressive how broad the Chinese automotive industry’s offering is only a few years after expanding into Europe – from affordable entry-level EVs to technologically advanced luxury saloons, almost everything is covered. What Chinese manufacturers still lack are strong brand identities and a certain independence – both in terms of design and the driving experience.

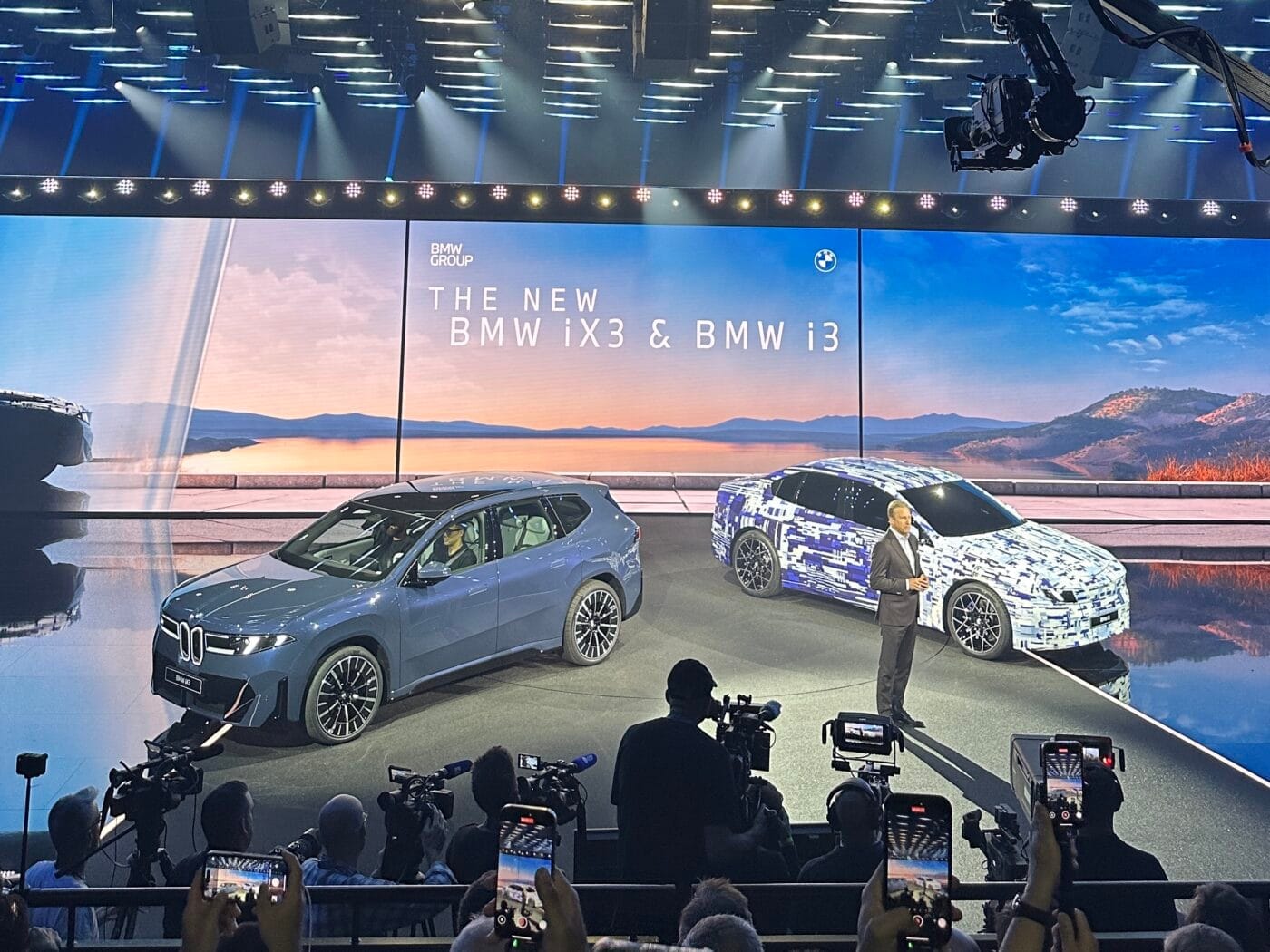

BMW’s Neue Klasse overshadows all other launches

This brings us to the traditional strengths of the German automakers. After lagging behind Chinese competitors in EV technology in recent years, they demonstrated at IAA Mobility 2025 that they are far from done. The show was dominated by the premiere of two direct rivals – BMW unveiled the second generation of its electric mid-range SUV iX3, while Mercedes presented the GLC with EQ technology.

With the upcoming iX3, the Munich-based manufacturer not only catches up with the competition but once again takes a technological lead. The completely redesigned 800-volt platform provides top-class peak charging of 400 kW and a truly long-range capable battery. It also features an entirely new cockpit layout and upgraded hardware.

While Xpeng’s new generation may charge even faster, the combination of progressive design, reasonable pricing, and the strong image of BMW’s established brand means the first model of the Neue Klasse family is likely to succeed and push the local automotive industry forward – ideally even in China, where German brands have historically faced challenges.

Mercedes moves away from rounded EQ styling

The German rival counters with the GLC EQ. While the carmaker’s mid-range SUV is outperformed by the iX3 in most areas, its technical specifications remain impressive. Mercedes’ latest family member charges at up to 330 kW thanks to 800-volt technology and achieves up to 713 km on a single WLTP-rated charge. It also offers a practical towing capacity of 2.4 tonnes.

The design is more evolutionary and, compared with BMW, somewhat baroque. The large chrome-effect grille seems out of place on a pure EV. Following the disappointing performance of the progressively styled EQ models, Mercedes is deliberately reducing the visual differences between electric and combustion-engine models.

Volkswagen focuses on affordable e-mobility

Even in Wolfsburg, people seem finally on board. At the Media Preview, the VW Group presented its upcoming quartet of affordable electric cars. The front-wheel-drive models built on the “MEB+” platform – the VW ID.Polo, its SUV counterpart the VW ID.Cross, and the small crossovers Skoda Epiq and Cupra Raval – received by far the most applause from the attending industry audience. Although the production versions will not arrive until 2026, the camouflaged prototypes and near-production concept cars already made a good impression. In particular, the Volkswagen core brand returns to traditional values – intuitive operation, affordable technology and timeless design. The announced starting prices of around €25,000 are likely to catapult the entire quartet into the top ten EVs.

Audi, the premium subsidiary, presented the retro-futuristic Concept C study. The minimalist design by new chief designer Massimo Frascella polarises, but the silver two-seater could mark a new design language in Ingolstadt. The parallels to the Jaguar Type 00 from last year are no coincidence – Frascella led JLR’s design before moving to Germany.

Skoda’s “Vision O” study at the Open Space gave a preview of the Octavia Combi’s successor, while Cupra jumped on the range extender trend with its brand-typical aggressively styled Concept Car Tindaya.

Porsche’s only world premiere at IAA Mobility was the updated 911 Turbo S. The classic combustion-engine sports car, however, was overshadowed by the mass of exciting electric novelties. The fully electric Cayenne was not ready in time for the home show and is expected to be unveiled later this year. Porsche did present a still-camouflaged prototype and its inductive charging system. The premium SUV will at least optionally become one of the first EVs capable of cable-free charging.

Conclusion

This year’s IAA Mobility once again highlighted the ambitions of Chinese automakers in the European market. Apart from the high-tech EVs from Xpeng and Nio, there are few new models from the Far East that truly stand out. Most vehicles exported to Europe are interchangeable compact SUVs, which score points with low prices and extensive equipment but mostly lack character and only rank mid-field in terms of range and charging technology.

The upcoming iX3, by contrast, demonstrates what is possible when elements of a brand’s heritage are combined with modern battery technology and advanced software. No car drew more attention at the IAA Mobility than probably the most important BMW since the 1960s. The Mercedes GLC EQ competitor and VW Group’s affordable EVs due in 2026 show that German automakers can still deliver – if they choose to. In two years, the Munich exhibition grounds will reveal whether the turnaround has truly succeeded.

0 Comments